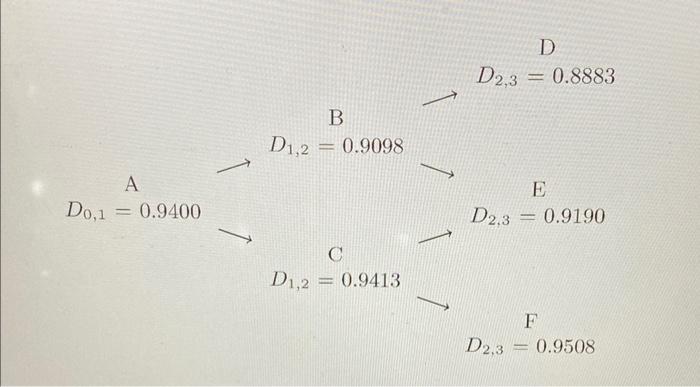

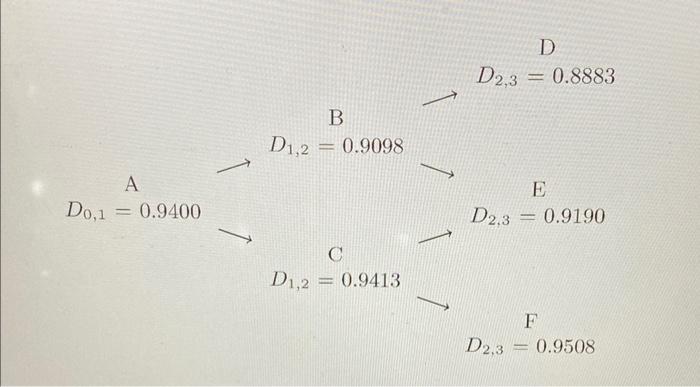

Question: Using the following short-term discount factor tree inplied by the Ho-Lee model: D)D2,3=0.8883BD1,2=0.9098D0,1A=0.9400CD2,3=0.9190D1,2=0.9413FD2,3=0.9508 t=0t=1t=2 Consider a put option with a strike price X=980 and maturity

Using the following short-term discount factor tree inplied by the Ho-Lee model:

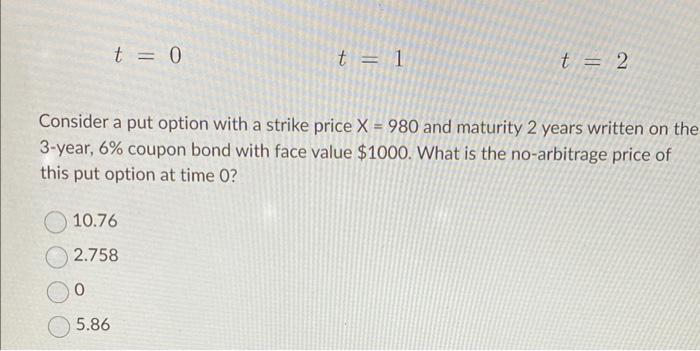

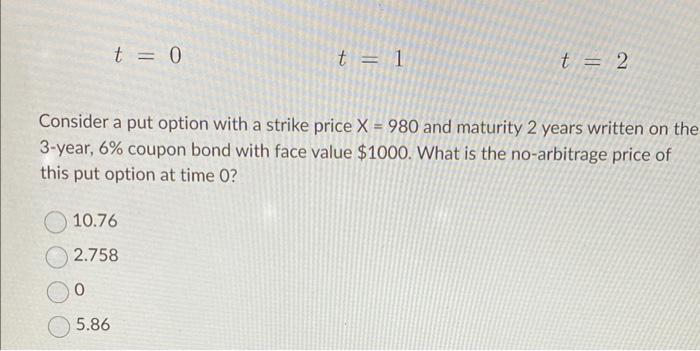

D)D2,3=0.8883BD1,2=0.9098D0,1A=0.9400CD2,3=0.9190D1,2=0.9413FD2,3=0.9508 t=0t=1t=2 Consider a put option with a strike price X=980 and maturity 2 years written on the 3 -year, 6% coupon bond with face value $1000. What is the no-arbitrage price of this put option at time 0 ? \begin{tabular}{|l|} \hline 10.76 \\ \hline 2.758 \\ \hline 0 \\ \hline 5.86 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock