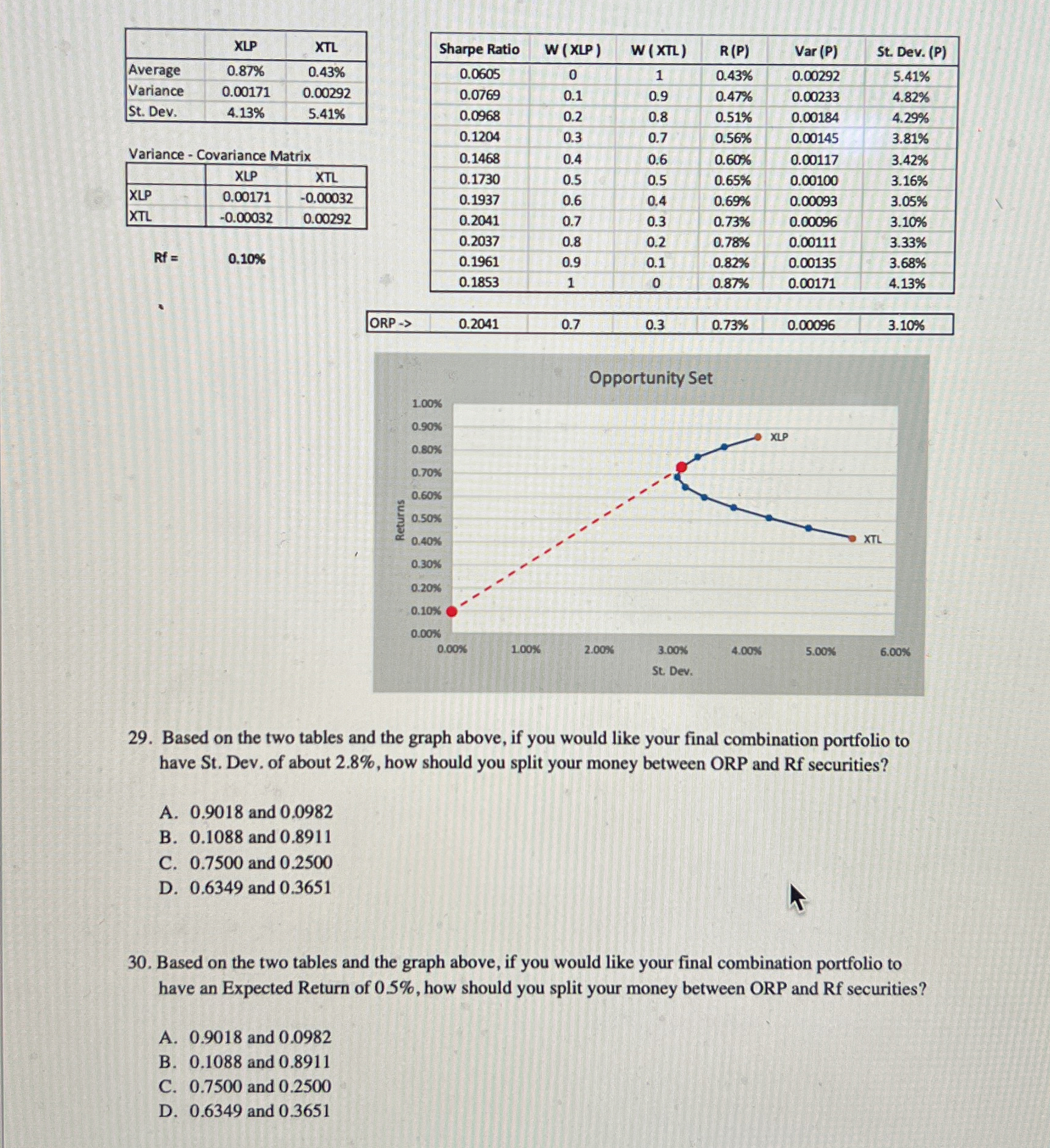

Question: Variance - Covariance Matrix Based on the two tables and the graph above, if you would like your final combination portfolio to have St .

Variance Covariance Matrix

Based on the two tables and the graph above, if you would like your final combination portfolio to

have St Dev. of about how should you split your money between ORP and Rf securities

A and

B and

C and

D and

Based on the two tables and the graph above, if you would like your final combination portfolio to

have an Expected Return of how should you split your money between ORP and Rf securities

A and

B and

C and

D and

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock