Question: You have a groundbreaking idea to develop a new technology that would change the world. You have approached a venture capitalist, asking for a $100

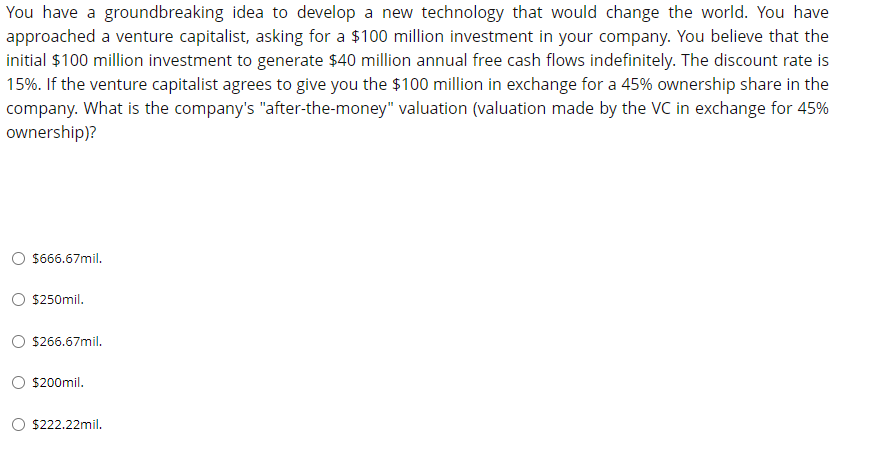

You have a groundbreaking idea to develop a new technology that would change the world. You have approached a venture capitalist, asking for a $100 million investment in your company. You believe that the initial $100 million investment to generate $40 million annual free cash flows indefinitely. The discount rate is 15%. If the venture capitalist agrees to give you the $100 million in exchange for a 45% ownership share in the company. What is the company's "after-the-money" valuation (valuation made by the VC in exchange for 45% ownership)? $666.67mil. O $250mil. $266.67mil. $200mil. $222.22mil

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts