Question: 2 0 2 2 - 2 0 2 3 CCHS Liv... KDE Licensure MyAccount | Americ... FastForwardAcademy Expungement Certif... You Will Love Histor... History -

CCHS Liv...

KDE Licensure

MyAccount Americ...

FastForwardAcademy

Expungement Certif...

You Will Love Histor...

History Gran

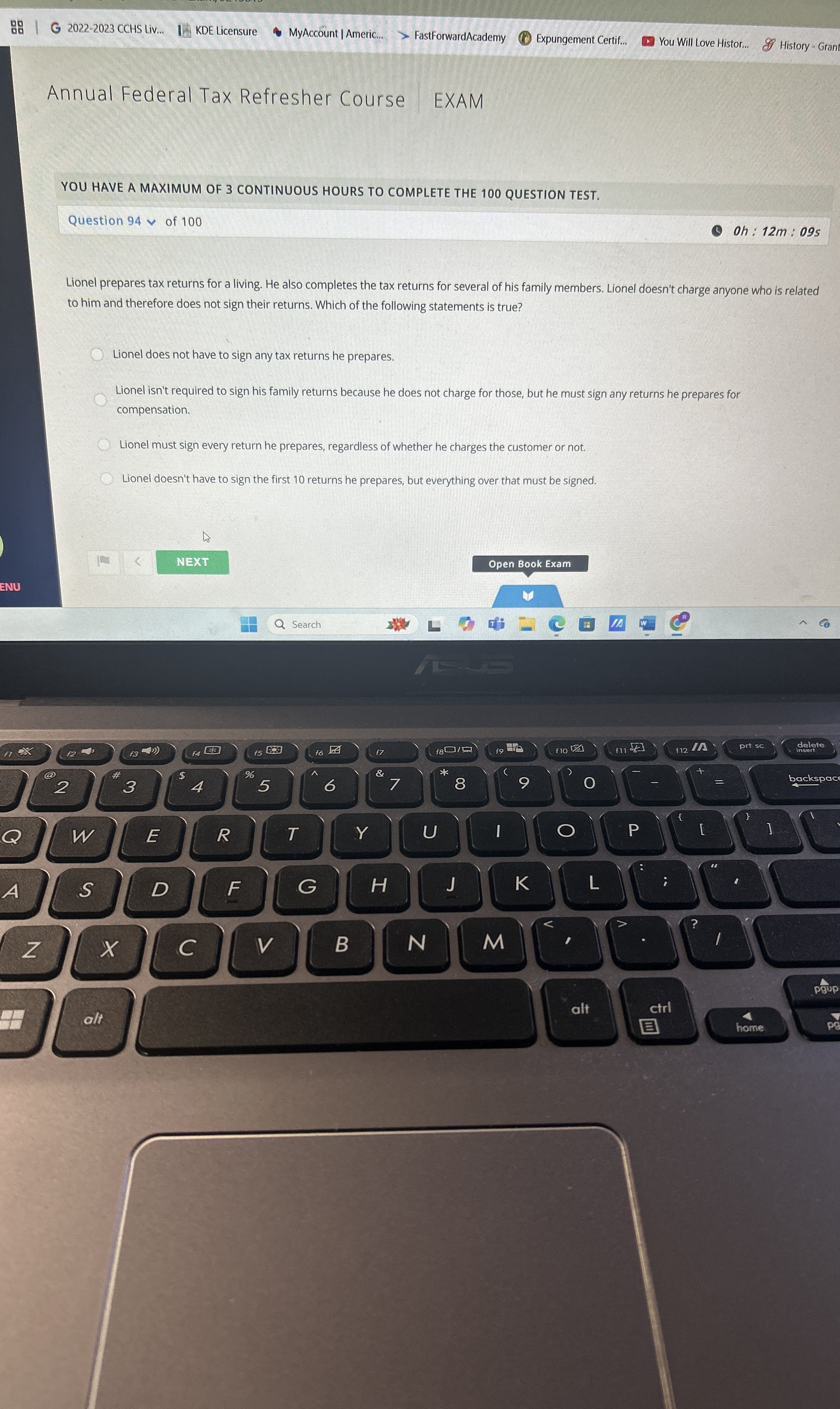

Annual Federal Tax Refresher Course

EXAM

YOU HAVE A MAXIMUM OF CONTINUOUS HOURS TO COMPLETE THE QUESTION TEST.

Question of

Oh: : s

Lionel prepares tax returns for a living. He also completes the tax returns for several of his family members. Lionel doesn't charge anyone who is related to him and therefore does not sign their returns. Which of the following statements is true?

Lionel does not have to sign any tax returns he prepares.

Lionel isn't required to sign his family returns because he does not charge for those, but he must sign any returns he prepares for compensation.

Lionel must sign every return he prepares, regardless of whether he charges the customer or not.

Lionel doesn't have to sign the first returns he prepares, but everything over that must be signed.

Search

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock