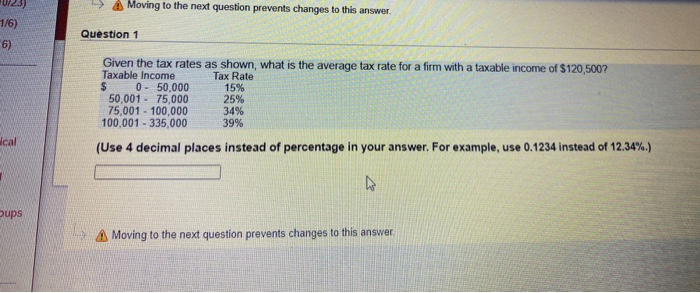

Question: A Moving to the next question prevents changes to this answer 1/6) 6) Question 1 Given the tax rates as shown, what is the average

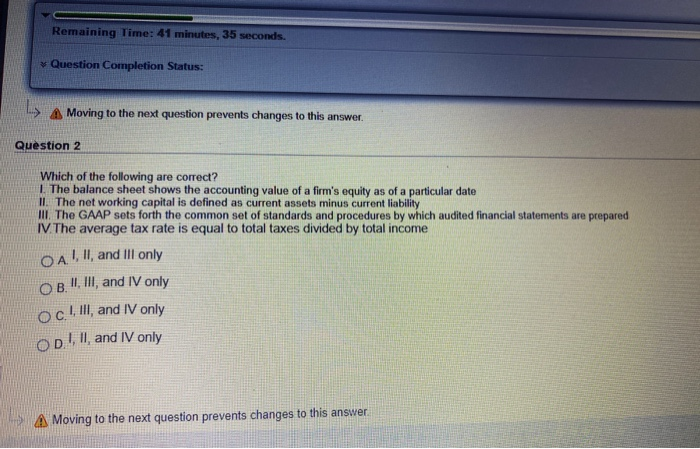

A Moving to the next question prevents changes to this answer 1/6) 6) Question 1 Given the tax rates as shown, what is the average tax rate for a firm with a taxable income of $120,500? Taxable income Tax Rate $ 0 - 50,000 15% 50,001 - 75,000 25% 75,001 - 100,000 34% 100,001 - 335,000 39% cal (Use 4 decimal places instead of percentage in your answer. For example, use 0.1234 instead of 12.34%.) N. ups A Moving to the next question prevents changes to this answer Remaining Time: 41 minutes, 35 seconds. Question Completion Status: A Moving to the next question prevents changes to this answer Question 2 Which of the following are correct? 1. The balance sheet shows the accounting value of a firm's equity as of a particular date II. The net working capital is defined as current assets minus current liability III. The GAAP sets forth the common set of standards and procedures by which audited financial statements are prepared IV The average tax rate is equal to total taxes divided by total income OA', II, and Ill only OB. II, III, and IV only Oc1III, and IV only ODI,II , and IV only Moving to the next question prevents changes to this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts