Question: Answer without using excel and minimize shortcuts including the use if a financial calculator. Please show all work Q3) McKeman inc. imposes a payback cutoff

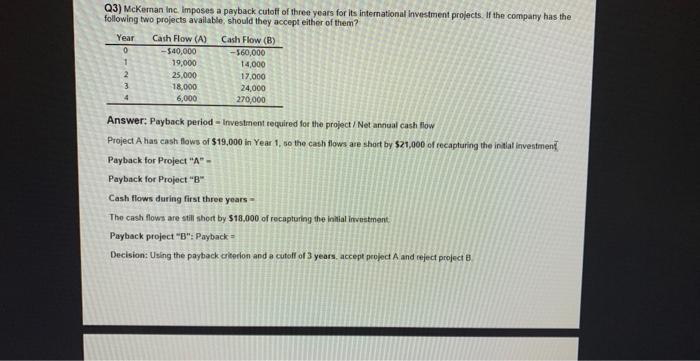

Q3) McKeman inc. imposes a payback cutoff of three years for its international investment prolects. If the company has the following two projects available, should they accept either of them? Answer: Payback period - Investanent tequired for the project / Net annual cash flow Project A has cash flows of $19,000 in Year 1,50 the cash flows are shoct by $21,000 of recapturing the initial investment. Payback for Project " A"= Payback for Project "B" Cash flows during first three years = The cash flows are still short by $18.000 of recapturing the inilial investment: Payback project "B": Payback = Decision: Using the payback citerion and a cutolf of 3 years, accept propect A and reject project B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts