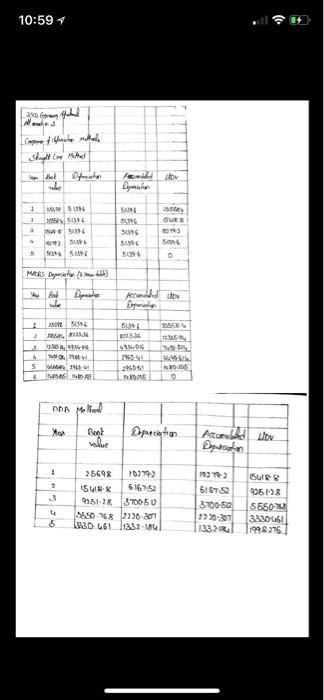

Question: Based on the first 3 year accumulated depreciation values (neglecting country) from your table which method should be selected for tax purposes? Why? 2. 3.

Based on the first 3 year accumulated depreciation values (neglecting country) from your table which method should be selected for tax purposes? Why? 2. 3. What is the book value for each method at the end of the recovery period? 4. Which method has a salvage value that has not been met at the end of the recovery period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts