Question: I have a financial mathematics problems. Bonus Problem 1 (Optional, 30 marks) We consider a market with 3 risky assets. You are given that 0.06

I have a financial mathematics problems.

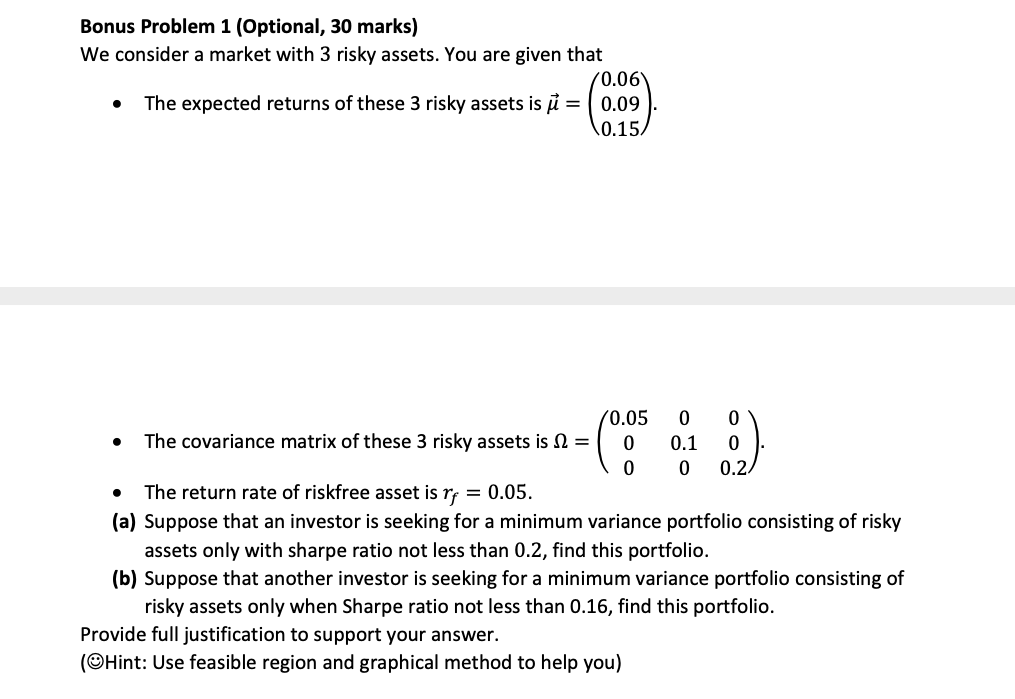

Bonus Problem 1 (Optional, 30 marks) We consider a market with 3 risky assets. You are given that 0.06 . The expected returns of these 3 risky assets is E = (0.09). 0.15 0.05 0 0 o The covariance matrix ofthese 3 risky assets is (1 = 0 0_1 0 . 0 0 0.2 o The return rate of riskfree asset is rf = 0.05. (a) Suppose that an investor is seeking for a minimum variance portfolio consisting of risky assets only with sharpe ratio not less than 0.2, nd this portfolio. (b) Suppose that another investor is seeking for a minimum variance portfolio consisting of risky assets only when Sharpe ratio not less than 0.16, find this portfolio. Provide full justication to support your answer. (Hint: Use feasible region and graphical method to help you)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts