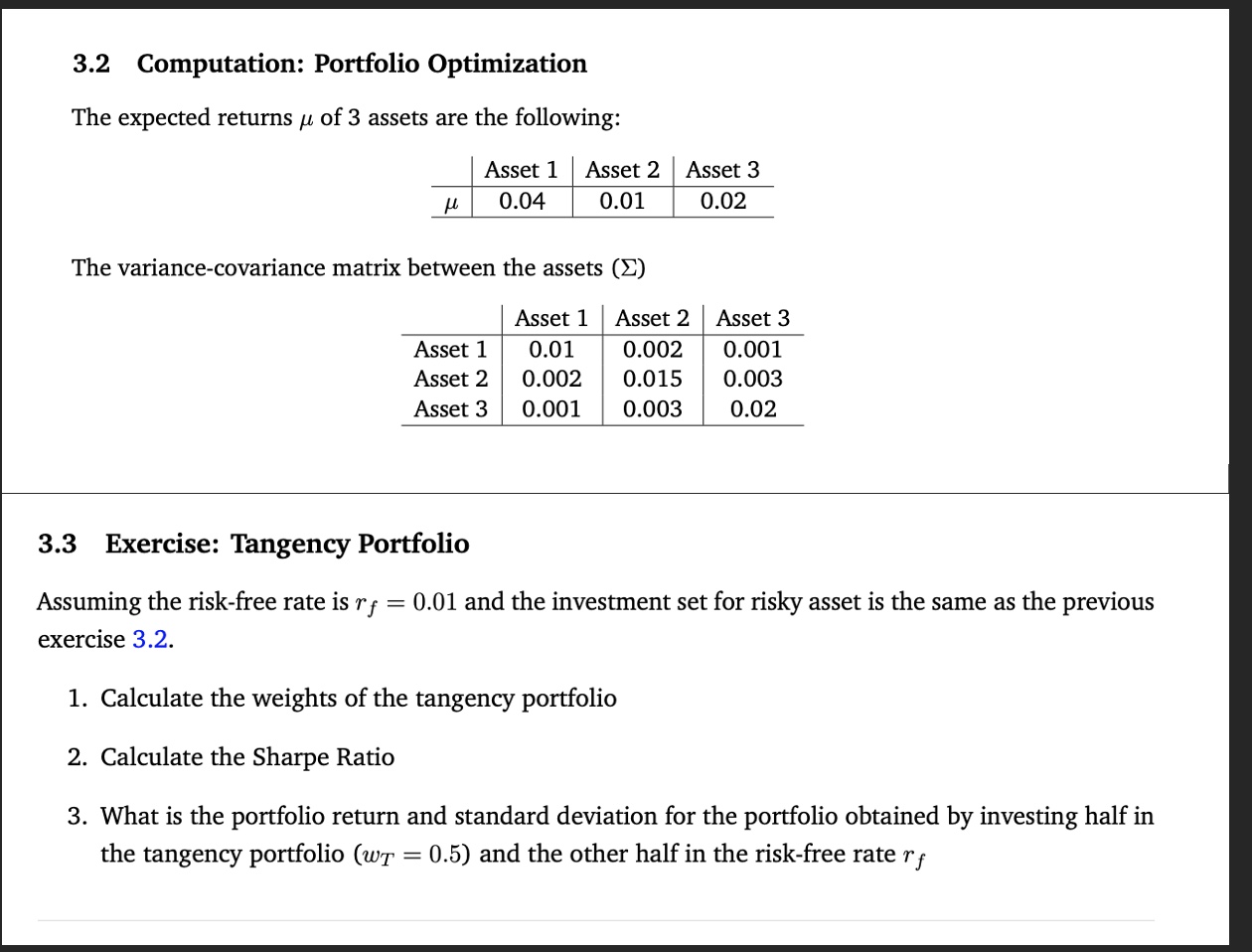

Question: by hand or python code 3.2 Computation: Portfolio Optimization The expected returns of 3 assets are the following: The variance-covariance matrix between the assets ()

by hand or python code

3.2 Computation: Portfolio Optimization The expected returns of 3 assets are the following: The variance-covariance matrix between the assets () 3.3 Exercise: Tangency Portfolio Assuming the risk-free rate is rf=0.01 and the investment set for risky asset is the same as the previous exercise 3.2. 1. Calculate the weights of the tangency portfolio 2. Calculate the Sharpe Ratio 3. What is the portfolio return and standard deviation for the portfolio obtained by investing half in the tangency portfolio (wT=0.5) and the other half in the risk-free rate rf

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts