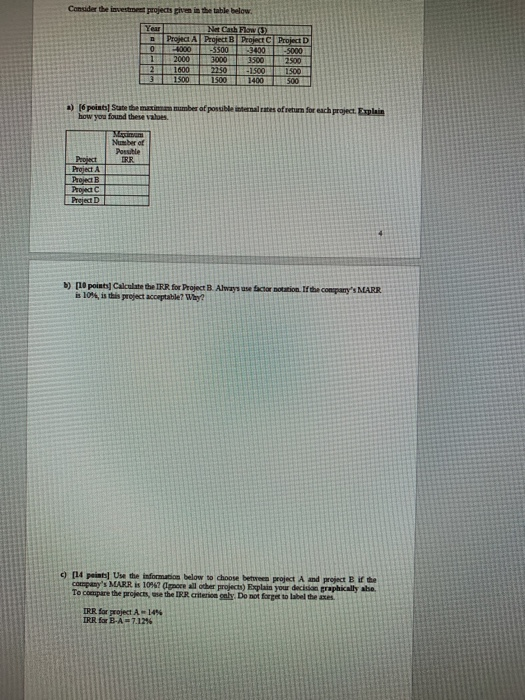

Question: Consider the investor projects given in the table below. Year 0 1 2 13 Net Cash Flow (5) Project A Project B Project Project D

Consider the investor projects given in the table below. Year 0 1 2 13 Net Cash Flow (5) Project A Project B Project Project D -5500 -3450 -5000 2000 3000 3500 2500 1600 2250 -1500 1500 1500 1500 1400 500 a) [6 point Suate the maximum number of possible internal rates of return for each project. Explain how you found these values. Mequinem Number of Postle IRR Project Project A Project B Prod Prejed D >) [10 points Calculate the IRR for Project B. Always use factor notation. If the company's MARR is 10%, is this project acceptable? Why? [14 peints Use the information below to choose between project A and project B if the company's MARR is 10% opere all other projects) Explain your decision graphically she To compare the projects, use the IRR Criterion caly. Do not forget to label the Axel IRR for project A 14% IRR for E-A=7.124

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts