Question: Evaluate the internal and external sales environment while you were planning your proposal to the client include the following: what you knew about client and

Evaluate the internal and external sales environment while you were planning your proposal to the client include the following:

what you knew about client and their buying behaviour

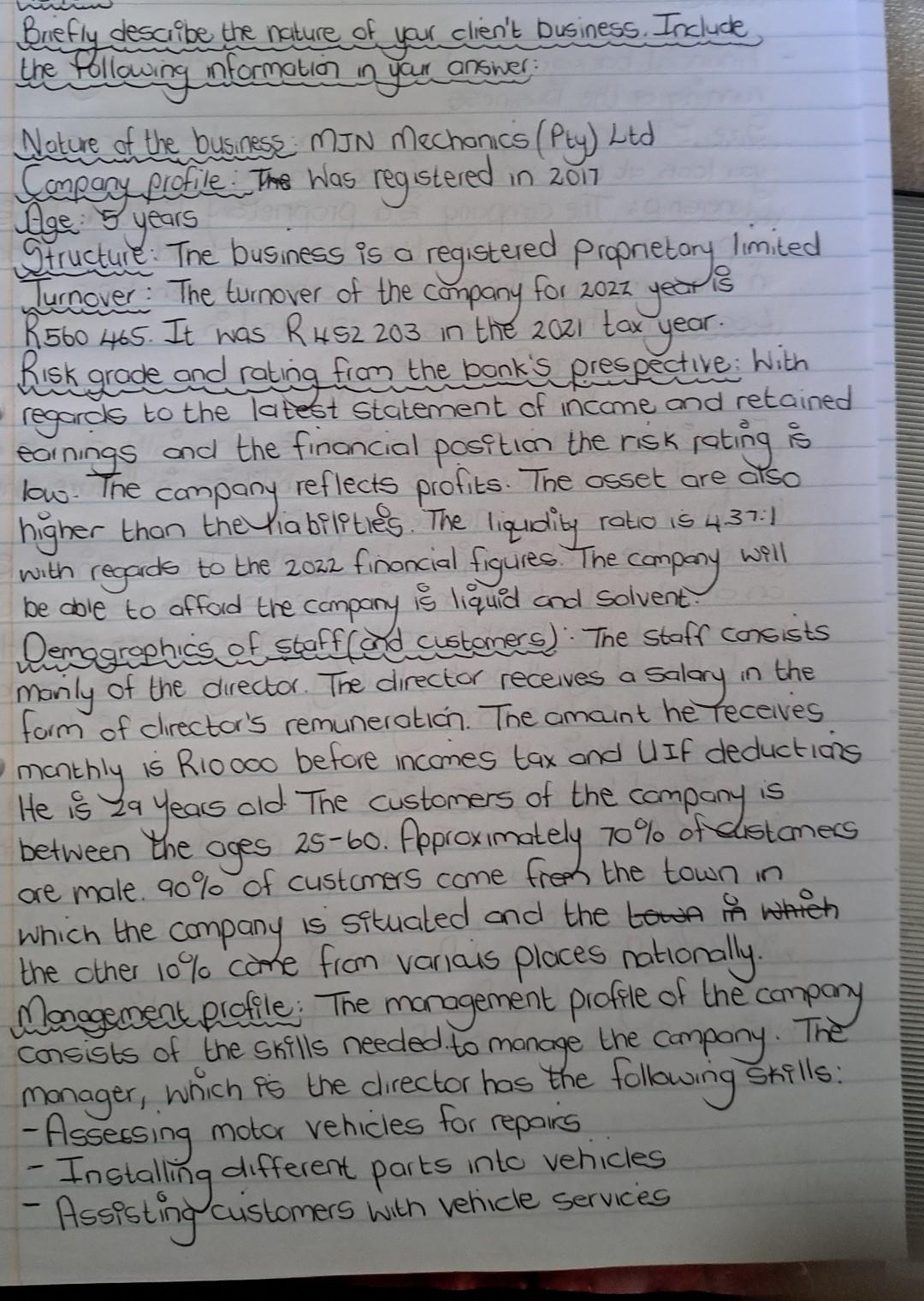

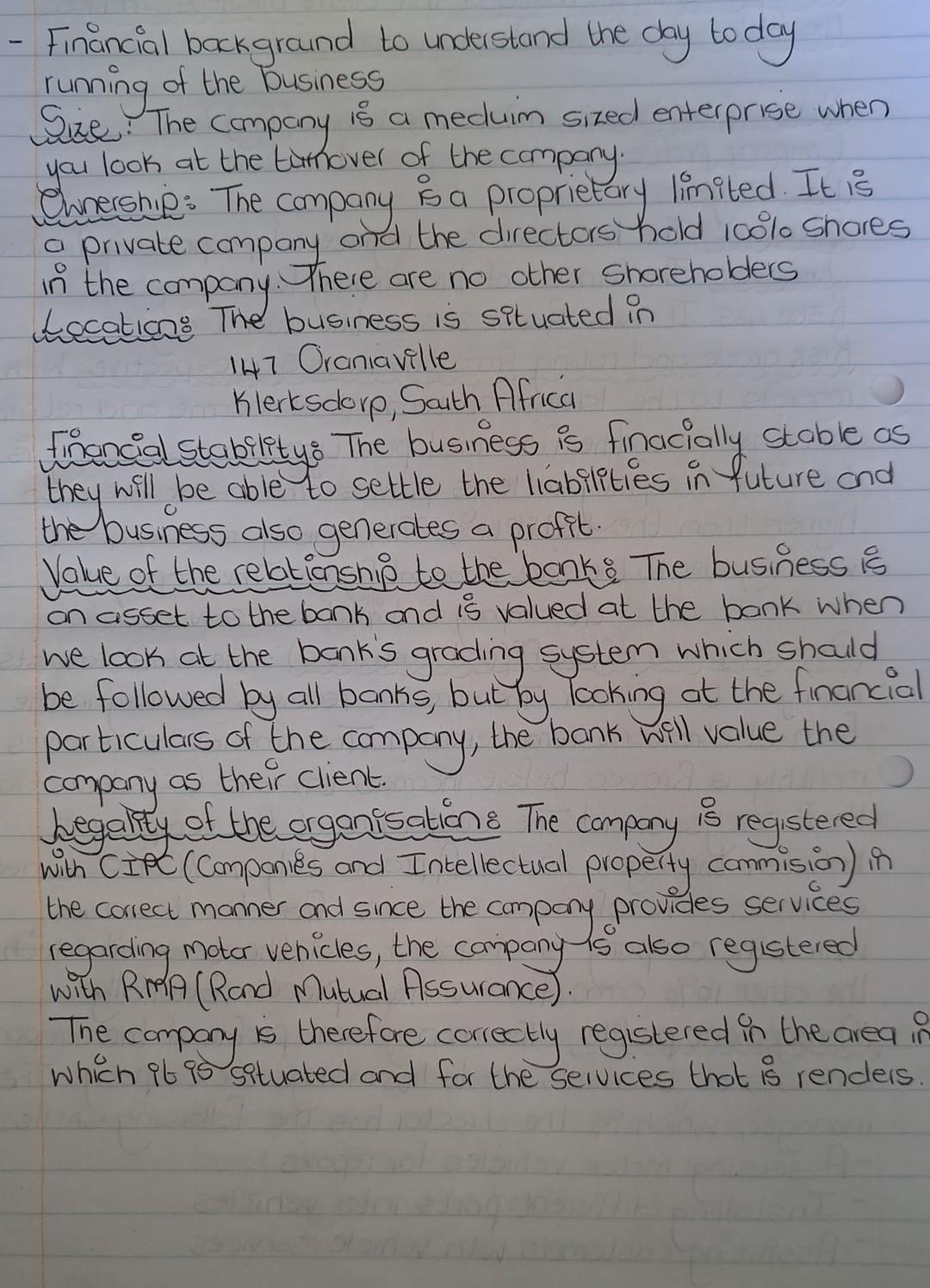

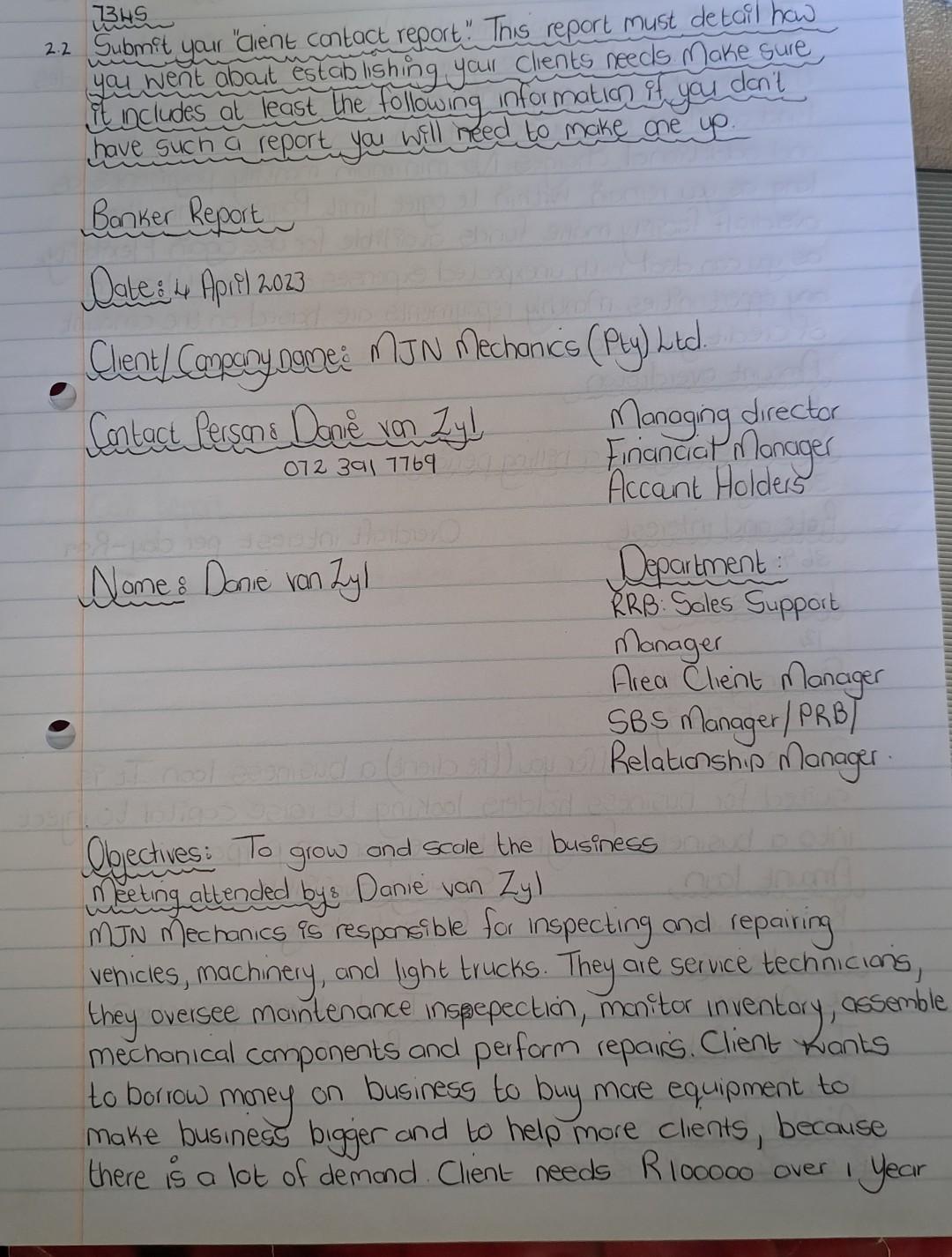

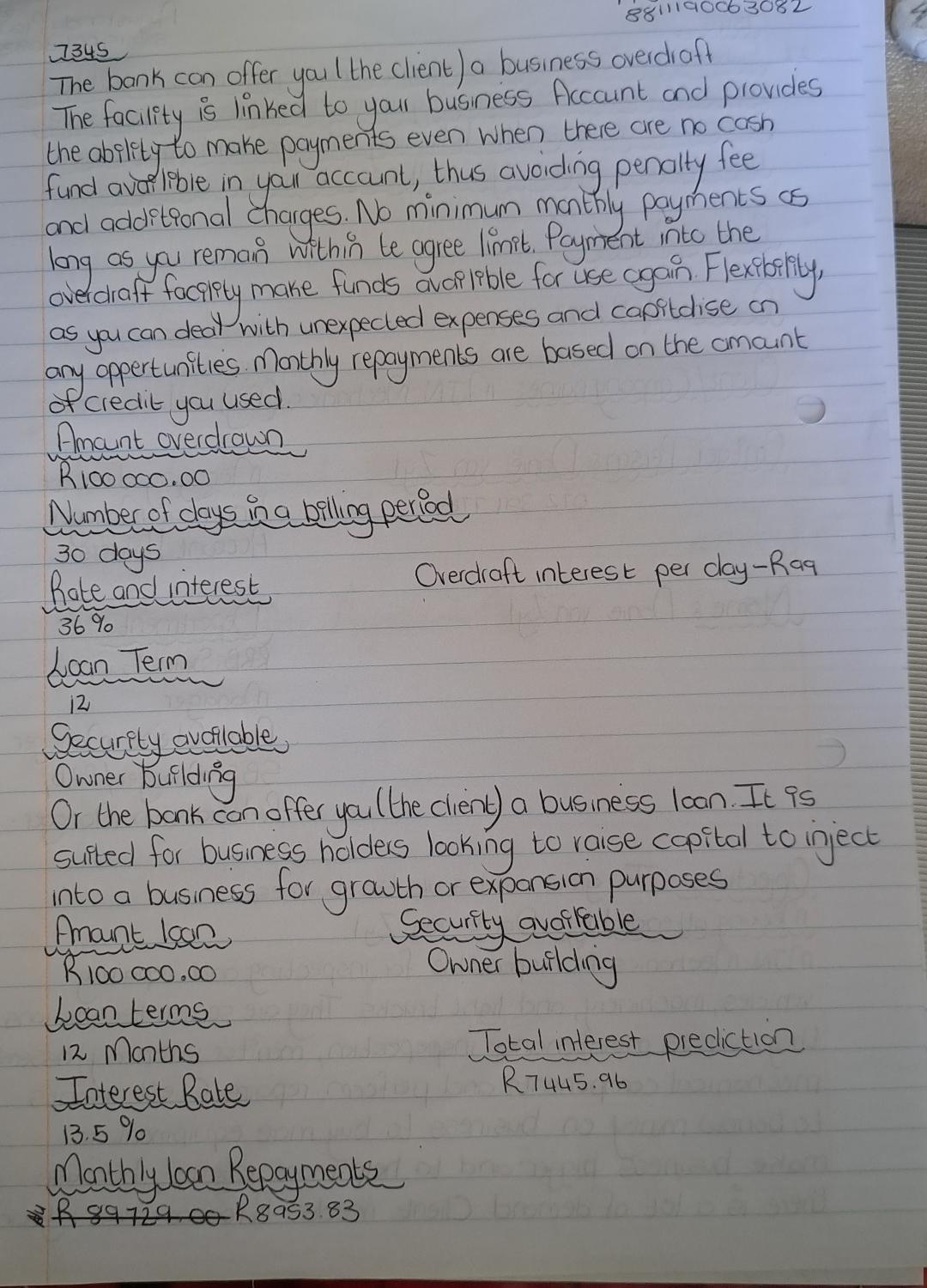

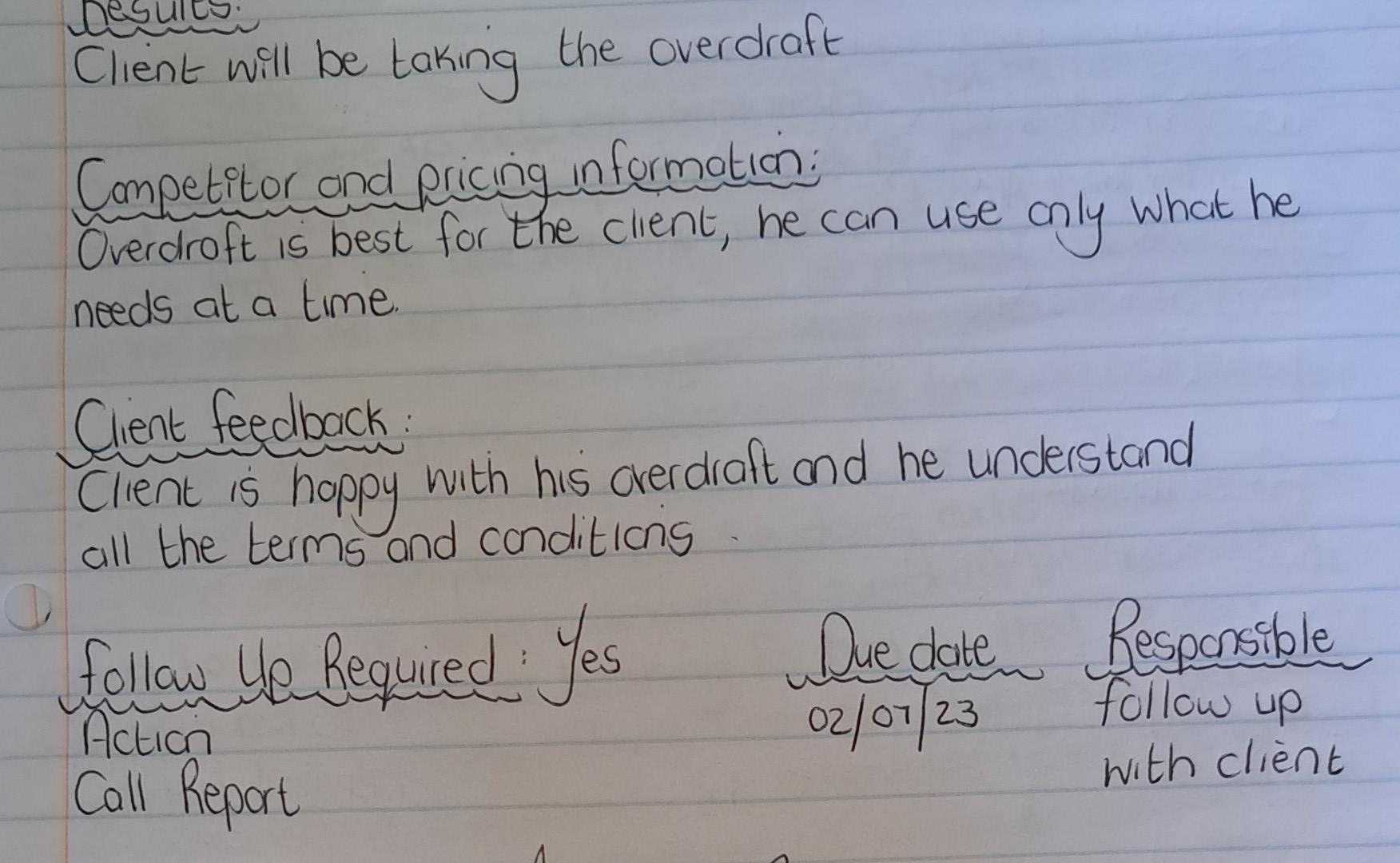

Briefly describe the nature of your clien't business. Include the following information in your ansiwer: Nature of the business: MJN mechanics (Pty) Ltd Company profile: The Was registered in 2017 Age: 5 years Structure: The business is a registered proprietary limited Turnover: The turnover of the company for 2022 yed is R560 465. It was RH52 203 in the 2021 tax year. Risk grade and rating from the bonk's prespective: With earnings and the financial position the risk rating is low. The company reflects profits. The osset are also higher than the liabilitles. The liqudity ratio is 4.37:1 with regards to the 2022 financial figures. The campany will be able to afford the company is liquid and solvent. Demggraphics of staff(and customers): The staff consists marily of the director. The director receives a salary in the form of clirector's remuneration. The amaint he Teceives manthly is R10000 before incomes tax and UIIf deductians He is 29 Years old. The customers of the company is between the ages 25-60. Approximately 70% of clistaness ore male. 90% of customers come frem the town in Which the company is situated and the towa in which the other 10\% came from variais places nationally. Monagement profile: The management profile of the compary consists of the skills needed. to manage the campany. The manager, which is the director has the following skills: - Assessing motor vehicles for repairs - Installing different parts into vehicles - Assisting cuistomers with vehicle services Financial backgraind to understand the day to day running of the business Size. The company is a meduim sized enterprise when yau look at the tarnover of the company. chnership: The company is a proprietary limited. It is a private company and the directors hold 100% shares in the company. There are no other shoreholders decation: The business is situated in 147 Oraniaville Klerksclorp, Saith Africa Financialstability: The business is finacially stable as they will be able to settle the liabilities in future and Value of the relationship to the bank: The business is an asset to the bank and is valued at the bank when we look at the bank's grading system which shaild be followed by all banks, but by looking at the financial particulars of the company, the bank will value the company as their client. hegality of the organisation: The company is registered with CIPC (Companies and Intellectual property commision) in the correct manner and since the compony provides services regarding motar vehicles, the company 15 also registered with RMA (Rand Mutual Assurance). The company is therefore correctly registered in the area in which it is situated and for the services that is renders. 2.2 Submit your "dient contact report". This report must detail how you went about estab lishing your clients needs. Make sure it includes at least the following information if you dan't have such a report you will need to make one yo. Banker Report Date: 4 April 2023 Client/ Company name: MIJN Rechanics (Pty) Ltd. Sontact Persans Danie van Zy! Managing director Financiat nanager Accant Holders Nome: Donie van Zyl Department: RRB: Soles Support Manager Area Client nanager SBS Manager/PRB) Relationshis nanager. Objectives: To grow and scole the business Meeting attended bys Danie van Zy l MJN mechanics is responsible for inspecting and repairing venicles, machinery, and light trucks. They are service technicians, they oversee maintenance inspepection, manitor inventory, assemble mechanical components and perform repairs. Client hants to borrow money on business to buy mare equipment to make business bigger and to help more clients, because there is a lot of demand. Client needs R100000 over I Year The bank con offer you l the client) a business overdiaft 7345 The facility is linked to your business Accaunt and provides the ability to make payments even when there are no cash fund avarlible in yaul account, thus avoiding penalty fee and additional charges. No minimum monthly payments os long as you remain within te agree limit. Poyment into the overdraft facgilty make funds availible for use again. Flexibility, as you can deat with unexpected expenses and capitdise on any oppertunities. monthly repayments are based on the amaint of credit you used. Amant overdrawn R 100000.00 Number of days in a billing period. 30 days Rate and interest Overdraft interest per day-Ra9 Loan Term Security available Owner building Or the bank can offer you (the client) a business loan. It is suited for business holders looking to raise copital to inject into a business for growth or expansion purposes Amant loan Security availeble Loan terms 12manthsInterestRateTotalinterestpredictionR7445.96 13.5% Manthly locn Repayments \& 89729.00 R 8953.83 Client will be taking the overdraft Competitor and pricing information: Overdroft is best for the client, he can use only what he needs at a time. Slient feedback: Client is hoppy with his overdraft and he understand all the terms and conditions follow ye Required: Yes Due date Responsible Acticn Call Report

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts