Question: G 2 0 2 2 - 2 0 2 3 CCHS Liv... KDE Licensure MyAccount | Americ... FastForwardAcademy Expungement Certif... You Will Love Histor... History

G CCHS Liv...

KDE Licensure

MyAccount Americ...

FastForwardAcademy

Expungement Certif...

You Will Love Histor...

History

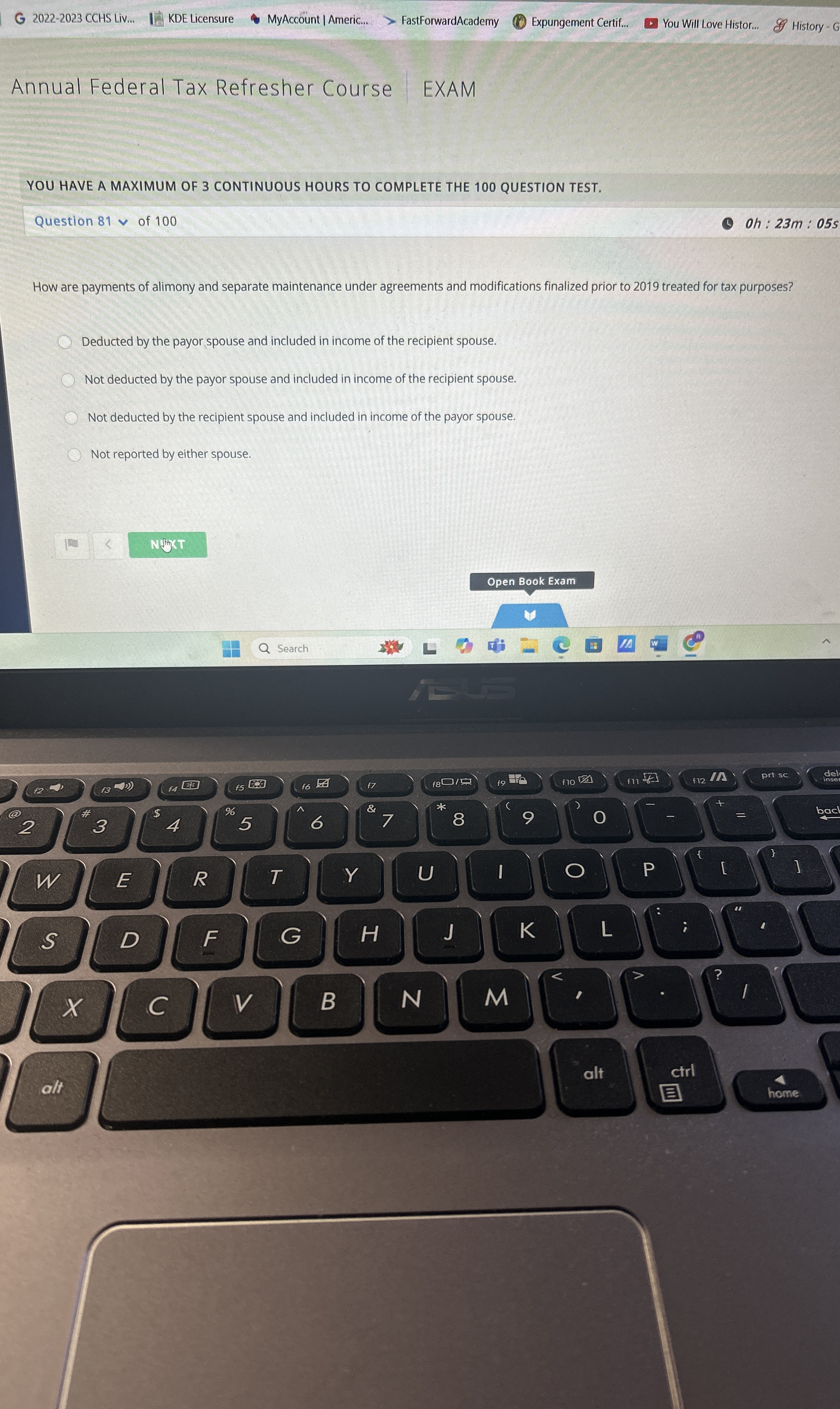

Annual Federal Tax Refresher Course

EXAM

YOU HAVE A MAXIMUM OF CONTINUOUS HOURS TO COMPLETE THE QUESTION TEST.

Question of

Oh : :

How are payments of alimony and separate maintenance under agreements and modifications finalized prior to treated for tax purposes?

Deducted by the payor spouse and included in income of the recipient spouse.

Not deducted by the payor spouse and included in income of the recipient spouse.

Not deducted by the recipient spouse and included in income of the payor spouse.

Not reported by either spouse.

Open Book Exam

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock