Question: Problem 2 (Required, 30 marks) We consider a market with N risky assets. The following table shows the information of some portfolios constructed by these

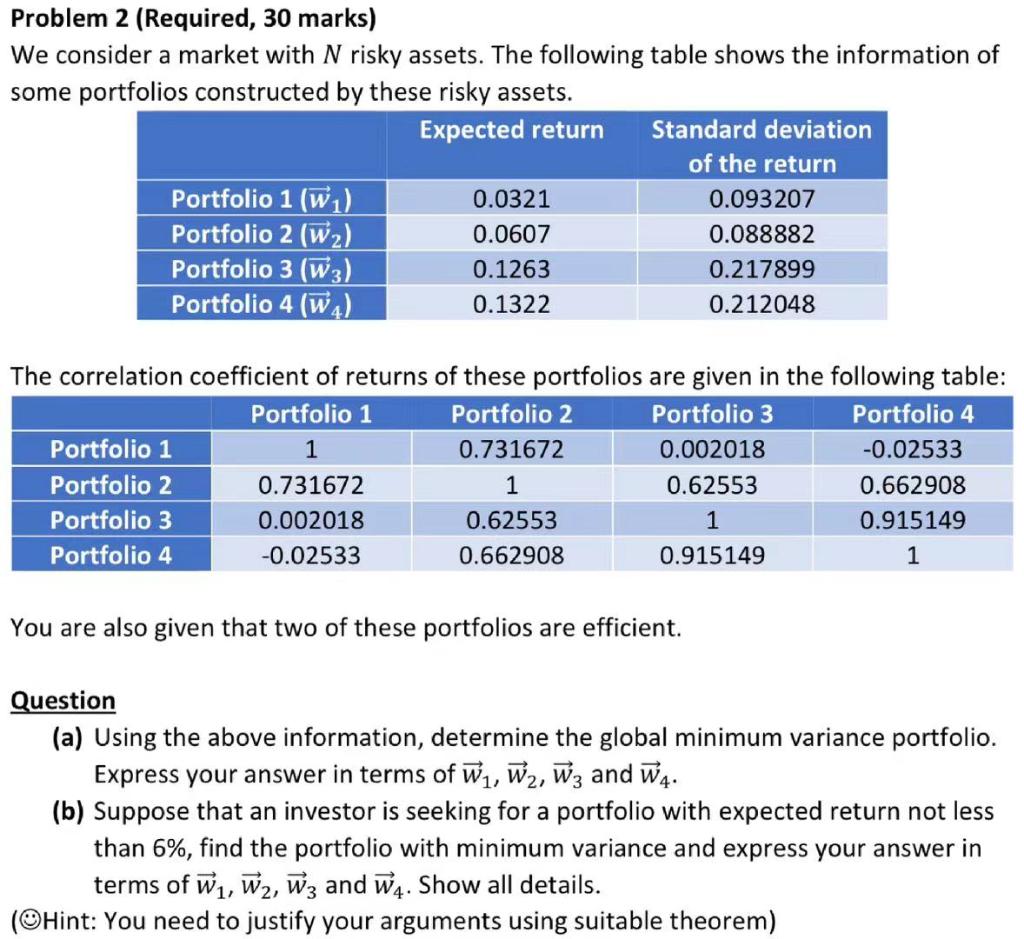

Problem 2 (Required, 30 marks) We consider a market with N risky assets. The following table shows the information of some portfolios constructed by these risky assets. The correlation coefficient of returns of these portfolios are given in the following table: You are also given that two of these portfolios are efficient. Question (a) Using the above information, determine the global minimum variance portfolio. Express your answer in terms of w1,w2,w3 and w4. (b) Suppose that an investor is seeking for a portfolio with expected return not less than 6%, find the portfolio with minimum variance and express your answer in terms of w1,w2,w3 and w4. Show all details. ()Hint: You need to justify your arguments using suitable theorem)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts