Question: please help. If you are unable to answer more than one question please do not reply. this is the best I could get the picture.

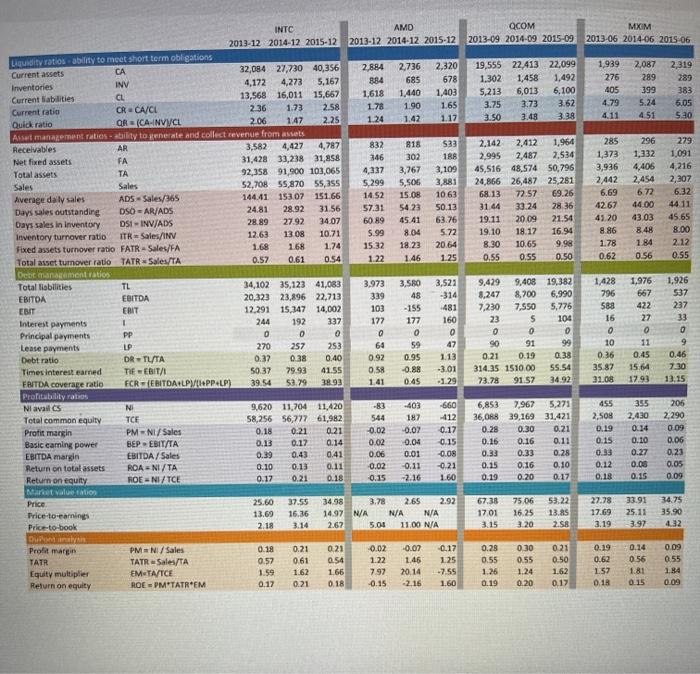

Question 25 1 pts What is the measure of ability to repay short-term debt? Debt ratio O EBITDA coverage ratio Times interest earned O Quick ratio D Question 26 1 pts Do you want this measure higher or lower? Higher O Lower Question 27 1 pts Which company performed best by this measure in 2015? INTC OMXIM AMD OQCOM QCOM 2013-09 2014-09 2015-09 MXM 2013-06 2014-06 2015-06 19,555 22.413 22,099 1.302 1,458 1,492 5,213 6,013 6,100 3.75 3.73 3.62 3.50 3.48 3.38 1,939 276 405 4.79 4.11 2,087 289 399 5.24 451 2.319 289 383 6.05 $30 2.142 2,412 1,964 2,995 2,487 2.534 45,516 48,574 50,796 24,866 26,487 25,281 68.13 72.57 69.26 31.44 33.24 28.36 19.11 20.09 21.54 19.10 18.17 16.94 8.30 10.65 9.98 0.55 0.55 0.50 285 1,373 3,936 2,442 6.69 4267 41.20 8.86 1.78 0.62 296 1,332 4,405 2,454 6.72 44.00 43.03 8.48 184 0.56 279 1,091 4,216 2,307 6.32 44 11 45.65 8.00 2.12 0.55 168 INTC AMD 2013-12 2014-12 2015-12 2013-12 2014-12 2015-12 Liquidity ratios ability to meet short term obligations Current assets CA 32,084 27,730 40,356 2884 2,736 2,320 INV Inventories 4,172 4,273 5,167 884 685 678 Current liabilities CL 13,568 16,011 15,667 1,618 1.440 1,403 Current ratio CRCA/CI 2.36 1.73 2.58 1.78 1.90 1.65 Quick ratio QR (CA INVVCL 2.06 1.47 2.25 124 1.42 1.17 Asset management ratios ability to generate and collect revenue from assets Receivables AR 3,582 4,427 4,787 832 818 S33 Net fixed assets FA 31,428 33,238 31,858 346 302 188 Total assets TA 92,358 91,900 103,065 4,337 3,767 3,109 Sales Sales 52,708 55,870 55,355 5.299 5,506 3.881 Average daily sales ADS - Sales/365 144.41 153.07 151.66 14.52 15.OR 10.63 Days sales outstanding DSO-AR/ADS 24.81 28.92 31.56 57.31 5423 50.13 Days sales in inventory DSI INV/ADS 28.89 27.92 3407 60.89 45.41 63.76 Inventory turnover ratio ITR = Sales/INV 12.63 13.08 10.71 5.99 8.04 5.72 Fixed assets turnover ratio FATR - Sales/FA 1.74 15 32 18 23 20.64 Total asset turnover ratio TATR Sales/TA 0.57 0.61 0.54 1.22 1.46 125 Det management ratios Total liabilities TL 34,102 35,123 41,083 3,973 3,580 3,521 EBITDA EBITDA 20,323 23.896 22,713 339 48 -314 EBIT EBIT 12.291 15,147 14.002 103 - 155 481 Interest payments 1 244 192 337 177 177 160 Principal payments PP 0 0 0 0 0 Lease payments UP 270 257 253 64 59 Debt ratio DRTL/TA 0.32 0.38 0.40 0.92 0.95 1.13 Times interest earned TIE - EBITA 50.37 79.93 41.55 0.58 -0.88 -3.01 EBITDA coverage ratio FCR (EBITDA LPMPPLP) 53.79 38.93 1.41 0.45 Profitability ratios Niavail CS NI 9,620 11,704 11,420 -83 -403 -660 Total common equity TCE 58,256 56,777 61,982 544 187 -412 Profit margin PMNI/Sales 0.18 0.21 0.21 -0.02 0.17 Basic caming power BEPEBIT/TA 0.13 0.17 0.14 0.02 0.04 0.15 EBITDA margin EBITDA/ Sales 0.39 0.43 0.41 0.06 0.01 0.08 Return on total assets ROANI/TA 0.10 0.13 0.11 0.02 0.11 -0.21 Return on equity ROENI/TCE 0.17 0.21 0.18 0.15 -2.16 1.60 Mire valueition Price . 25.60 37.55 34 98 3.78 2.65 2.92 Price-to-earning 13.69 16.36 14.97 N/A N/A N/A Price-to-book 2.18 3.14 2.62 5.00 11.00 NA DA Profit margin PMNi/Sales 0.18 0.21 0.21 -0.02 -0.07 -0.17 TATR TATR Sales/TA 0.57 0.61 0.54 1.22 1.46 125 Equity multiplier EM TA/TCE 1.62 166 792 2014 -7.55 Return on equity ROEPM'TATREM 0.17 0.21 0.18 -0.15 -2.16 1.60 9.429 9,408 19.382 3.247 8,700 6,990 7,230 7,550 5,776 23 5 0 0 0 91 99 0,21 0.19 0.38 314.35 1510.00 55.54 73.78 91 57 34.92 1,428 796 588 16 0 10 104 1,976 667 422 27 0 11 0.45 15 64 17.93 1,926 537 237 33 0 9 0.46 7.30 13.15 8 0.36 35.87 31.08 39 54 206 2,290 0.09 -0.02 6,853 7,967 5,271 36,088 39,169 31,421 0.28 0.30 0.21 0.16 0.16 0.11 0.33 0.33 0.28 0.15 0.16 0.10 0.19 0.20 0.17 455 2.508 0.19 0.15 0:33 0.12 0.18 355 2,430 0.34 0.10 0.27 0.08 0.06 0.23 0.05 0.15 0.09 67.38 17.01 3.15 75.06 16.25 3. 20 53.22 13.85 2.58 27.78 17.69 3.19 33.91 25.11 3.97 34.75 35.90 42 0.28 0.55 126 0.19 0.30 0.55 1.24 0.20 0.21 0.50 1.62 0.17 0.19 0.62 1.57 0.18 0.14 0.56 1.81 0.15 0.09 055 1.84 0.09 1.59

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts