Question: Please provide explonations for True or False starements Case 5: Syzmanowski v. Brace, 987 A.2d 717 (Super. Ct. Pa. 2009). (Mallor 16 Ed., C.P. 1,

Please provide explonations for True or False starements

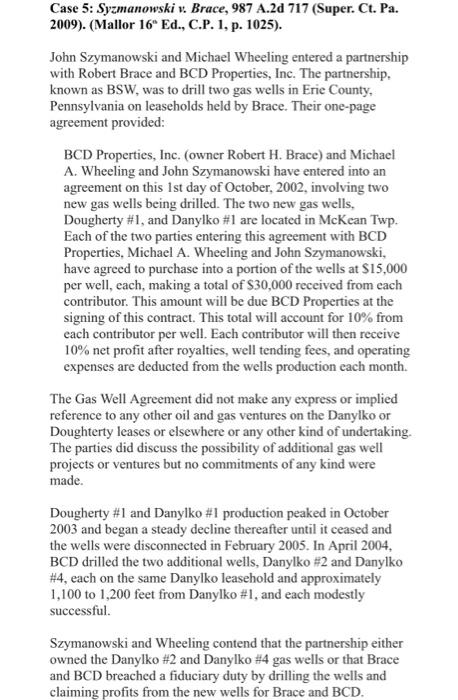

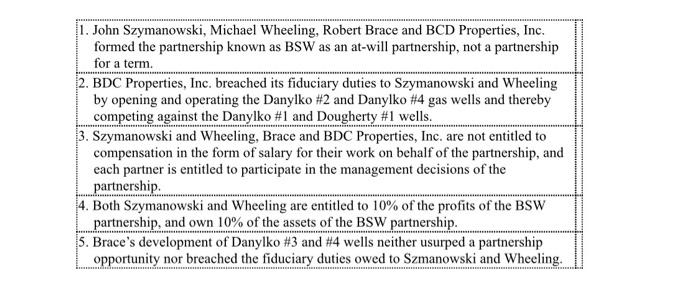

Case 5: Syzmanowski v. Brace, 987 A.2d 717 (Super. Ct. Pa. 2009). (Mallor 16 Ed., C.P. 1, p. 1025). John Szymanowski and Michael Wheeling entered a partnership with Robert Brace and BCD Properties, Inc. The partnership. known as BSW, was to drill two gas wells in Erie County, Pennsylvania on leaseholds held by Brace. Their one-page agreement provided: BCD Properties, Inc. (owner Robert H. Brace) and Michael A. Wheeling and John Szymanowski have entered into an agreement on this Ist day of October, 2002, involving two new gas wells being drilled. The two new gas wells, Dougherty #1, and Danylko #1 are located in McKean Twp. Each of the two parties entering this agreement with BCD Properties, Michael A. Wheeling and John Szymanowski, have agreed to purchase into a portion of the wells at $15,000 per well, each, making a total of $30,000 received from each contributor. This amount will be due BCD Properties at the signing of this contract. This total will account for 10% from each contributor per well. Each contributor will then receive 10% net profit after royalties, well tending fees, and operating expenses are deducted from the wells production each month. The Gas Well Agreement did not make any express or implied reference to any other oil and gas ventures on the Danylko or Doughterty leases or elsewhere or any other kind of undertaking. The parties did discuss the possibility of additional gas well projects or ventures but no commitments of any kind were made. Dougherty #1 and Danylko #1 production peaked in October 2003 and began a steady decline thereafter until it ceased and the wells were disconnected in February 2005. In April 2004, BCD drilled the two additional wells, Danylko #2 and Danylko #4, each on the same Danylko leasehold and approximately 1,100 to 1,200 feet from Danylko #1, and each modestly successful. Szymanowski and Wheeling contend that the partnership either owned the Danylko #2 and Danylko #4 gas wells or that Brace and BCD breached a fiduciary duty by drilling the wells and claiming profits from the new wells for Brace and BCD. 1. John Szymanowski, Michael Wheeling, Robert Brace and BCD Properties, Inc. formed the partnership known as BSW as an at-will partnership, not a partnership for a term. 2. BDC Properties, Inc. breached its fiduciary duties to Szymanowski and Wheeling by opening and operating the Danylko #2 and Danylko #4 gas wells and thereby competing against the Danylko #1 and Dougherty #1 wells. 3. Szymanowski and Wheeling, Brace and BDC Properties, Inc. are not entitled to compensation in the form of salary for their work on behalf of the partnership, and each partner is entitled to participate in the management decisions of the partnership 4. Both Szymanowski and Wheeling are entitled to 10% of the profits of the BSW partnership, and own 10% of the assets of the BSW partnership. 5. Brace's development of Danylko #3 and #4 wells neither usurped a partnership opportunity nor breached the fiduciary duties owed to Szmanowski and Wheeling. Case 5: Syzmanowski v. Brace, 987 A.2d 717 (Super. Ct. Pa. 2009). (Mallor 16 Ed., C.P. 1, p. 1025). John Szymanowski and Michael Wheeling entered a partnership with Robert Brace and BCD Properties, Inc. The partnership. known as BSW, was to drill two gas wells in Erie County, Pennsylvania on leaseholds held by Brace. Their one-page agreement provided: BCD Properties, Inc. (owner Robert H. Brace) and Michael A. Wheeling and John Szymanowski have entered into an agreement on this Ist day of October, 2002, involving two new gas wells being drilled. The two new gas wells, Dougherty #1, and Danylko #1 are located in McKean Twp. Each of the two parties entering this agreement with BCD Properties, Michael A. Wheeling and John Szymanowski, have agreed to purchase into a portion of the wells at $15,000 per well, each, making a total of $30,000 received from each contributor. This amount will be due BCD Properties at the signing of this contract. This total will account for 10% from each contributor per well. Each contributor will then receive 10% net profit after royalties, well tending fees, and operating expenses are deducted from the wells production each month. The Gas Well Agreement did not make any express or implied reference to any other oil and gas ventures on the Danylko or Doughterty leases or elsewhere or any other kind of undertaking. The parties did discuss the possibility of additional gas well projects or ventures but no commitments of any kind were made. Dougherty #1 and Danylko #1 production peaked in October 2003 and began a steady decline thereafter until it ceased and the wells were disconnected in February 2005. In April 2004, BCD drilled the two additional wells, Danylko #2 and Danylko #4, each on the same Danylko leasehold and approximately 1,100 to 1,200 feet from Danylko #1, and each modestly successful. Szymanowski and Wheeling contend that the partnership either owned the Danylko #2 and Danylko #4 gas wells or that Brace and BCD breached a fiduciary duty by drilling the wells and claiming profits from the new wells for Brace and BCD. 1. John Szymanowski, Michael Wheeling, Robert Brace and BCD Properties, Inc. formed the partnership known as BSW as an at-will partnership, not a partnership for a term. 2. BDC Properties, Inc. breached its fiduciary duties to Szymanowski and Wheeling by opening and operating the Danylko #2 and Danylko #4 gas wells and thereby competing against the Danylko #1 and Dougherty #1 wells. 3. Szymanowski and Wheeling, Brace and BDC Properties, Inc. are not entitled to compensation in the form of salary for their work on behalf of the partnership, and each partner is entitled to participate in the management decisions of the partnership 4. Both Szymanowski and Wheeling are entitled to 10% of the profits of the BSW partnership, and own 10% of the assets of the BSW partnership. 5. Brace's development of Danylko #3 and #4 wells neither usurped a partnership opportunity nor breached the fiduciary duties owed to Szmanowski and Wheeling