Question: Problem 4 (Required, 25 marks) We consider a mean-variance portfolio problem with 4 risky assets. You are given that The expected returns of these 4

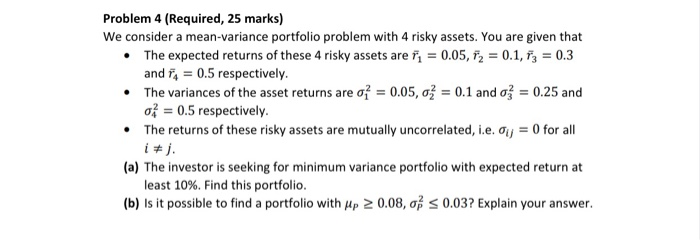

Problem 4 (Required, 25 marks) We consider a mean-variance portfolio problem with 4 risky assets. You are given that The expected returns of these 4 risky assets are fi = 0.05, 12 = 0.1, F3 = 0.3 and 4 = 0.5 respectively. The variances of the asset returns are o = 0.05, o = 0.1 and a} = 0.25 and 02 = 0.5 respectively. The returns of these risky assets are mutually uncorrelated, i.e. ou = 0 for all i # j. (a) The investor is seeking for minimum variance portfolio with expected return at least 10%. Find this portfolio. (b) is it possible to find a portfolio with Mp 20.08, o s 0.03? Explain your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts