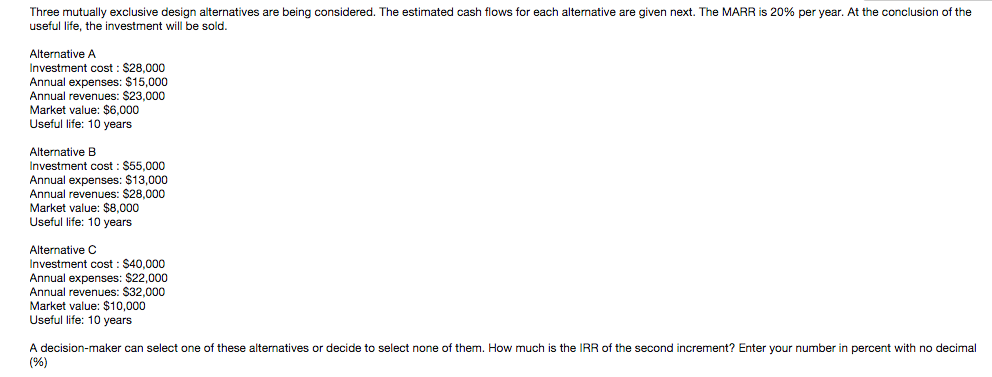

Question: Three mutually exclusive design alternatives are being considered. The estimated cash flows for each alternative are given next. The MARR is 20% per year. At

Three mutually exclusive design alternatives are being considered. The estimated cash flows for each alternative are given next. The MARR is 20% per year. At the conclusion of the useful life, the investment will be sold. A decision-maker can select one of these alternatives or decide to select none of them. How much is the IRR of the second increment? Enter your number in percent with no decimal (%)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock