Question: 2. please answer questions completely using multiple choice. The average of a firm's cost of equity and after tax cost of debt that is weighted

2.

please answer questions completely using multiple choice.

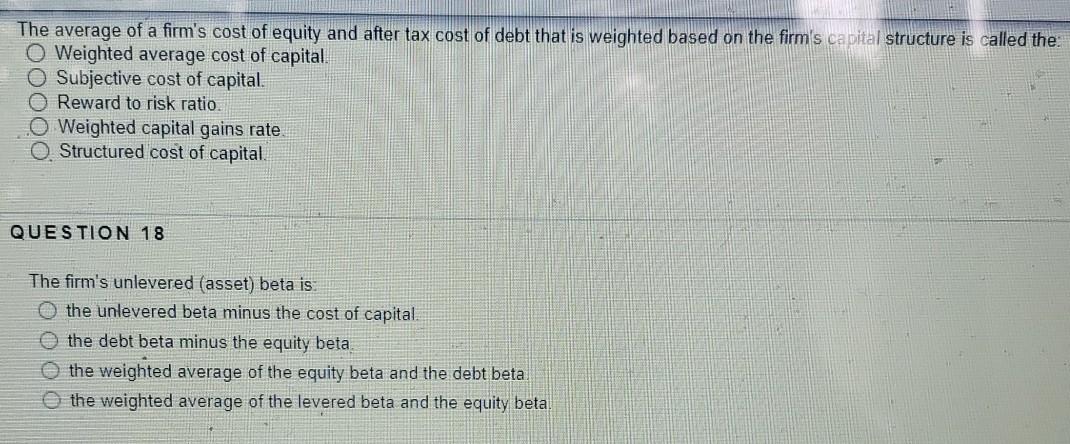

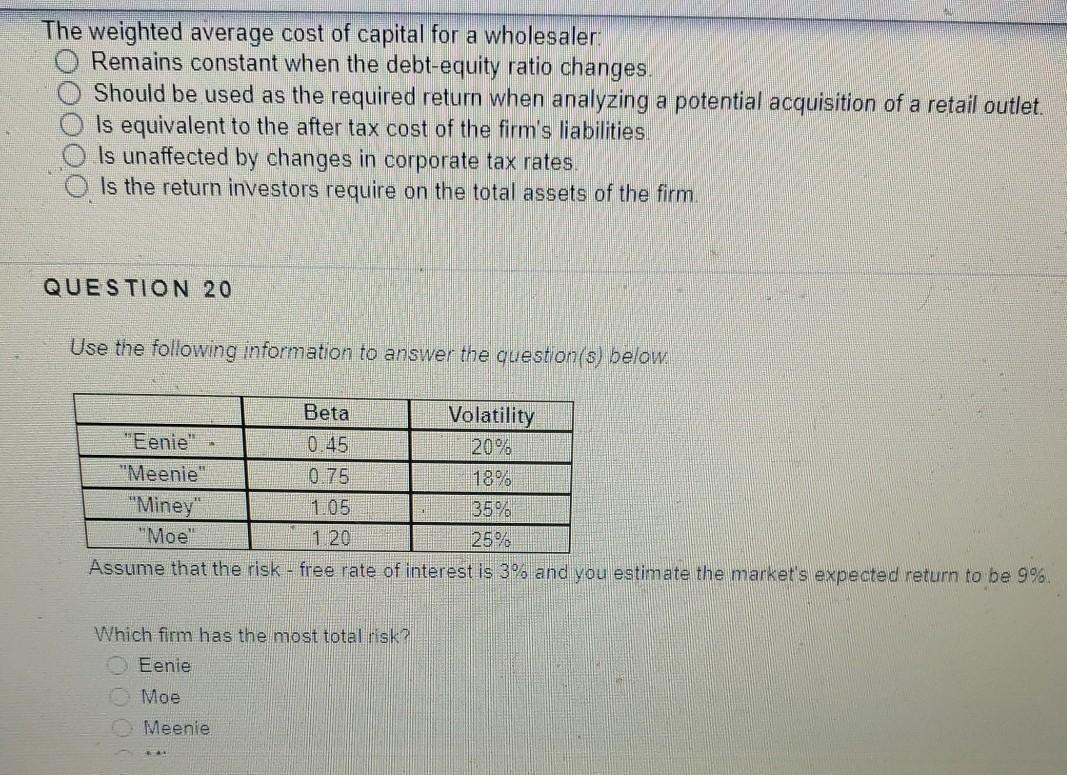

The average of a firm's cost of equity and after tax cost of debt that is weighted based on the firm's capital structure is called the O Weighted average cost of capital. O Subjective cost of capital. O Reward to risk ratio 0 Weighted capital gains rate. Structured cost of capital. QUESTION 18 The firm's unlevered (asset) beta is. the unlevered beta minus the cost of capital. the debt beta minus the equity beta the weighted average of the equity beta and the debt beta, the weighted average of the levered beta and the equity beta The weighted average cost of capital for a wholesaler. Remains constant when the debt-equity ratio changes. Should be used as the required return when analyzing a potential acquisition of a retail outlet. Is equivalent to the after tax cost of the firm's liabilities Is unaffected by changes in corporate tax rates. O is the return investors require on the total assets of the firm. QUESTION 20 Use the following information to answer the question(s) below. Beta Volatility "Eenie 0.45 20% Meenie" 0.75 18% "Miney" 105 35% "Moe" 120 25% Assume that the risk - free rate of interest is 3 and you estimate the market's expected return to be 9% Which firm has the most total risk? Eenie Moe Meenie

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts