Question: 2. please answer all questions completely using multiple choice MM Proposition I with taxes is based on the concept that: the capital structure of the

2.

please answer all questions completely using multiple choice

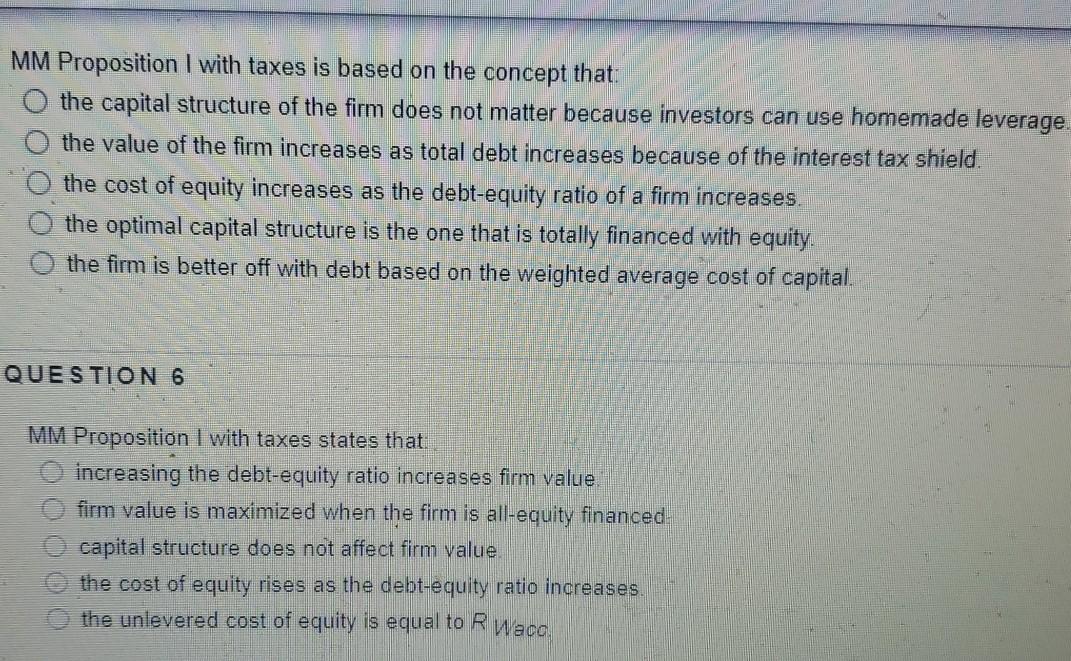

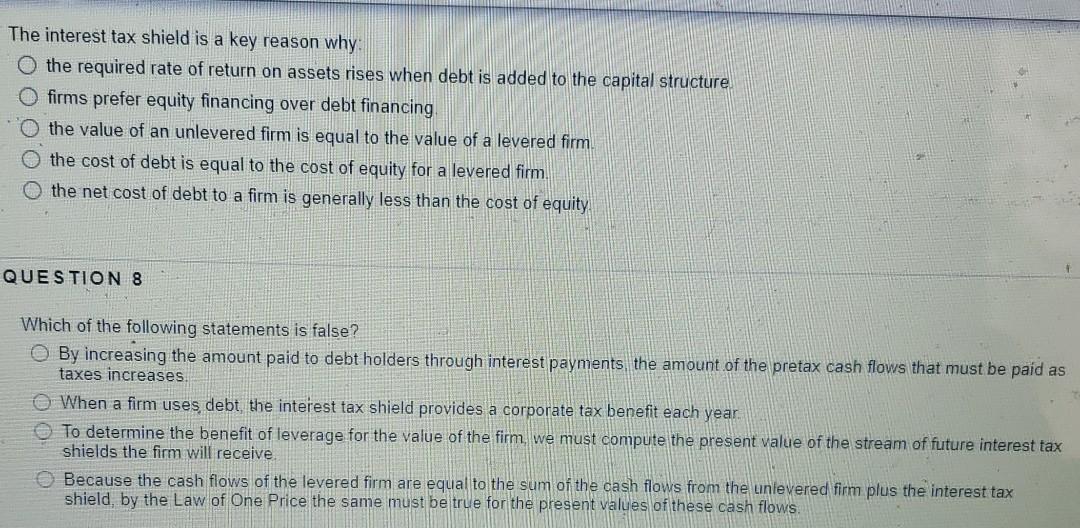

MM Proposition I with taxes is based on the concept that: the capital structure of the firm does not matter because investors can use homemade leverage. the value of the firm increases as total debt increases because of the interest tax shield. the cost of equity increases as the debt-equity ratio of a firm increases. the optimal capital structure is the one that is totally financed with equity. the firm is better off with debt based on the weighted average cost of capital. QUESTION 6 MM Proposition I with taxes states that increasing the debt-equity ratio increases firm value firm value is maximized when the firm is all-equity financed capital structure does not affect firm value the cost of equity rises as the debt-equity ratio increases. the unlevered cost of equity is equal to R Waco OOO The interest tax shield is a key reason why the required rate of return on assets rises when debt is added to the capital structure firms prefer equity financing over debt financing the value of an unlevered firm is equal to the value of a levered firm the cost of debt is equal to the cost of equity for a levered firm. the net cost of debt to a firm is generally less than the cost of equity QUESTION 8 Which of the following statements is false? By increasing the amount paid to debt holders through interest payments, the amount of the pretax cash flows that must be paid as taxes increases. When a firm uses debt the interest tax shield provides a corporate tax benefit each year To determine the benefit of leverage for the value of the firm we must compute the present value of the stream of future interest tax shields the firm will receive O Because the cash flows of the levered firm are equal to the sum of the cash flows from the unlevered firm plus the interest tax shield, by the Law of One Price the same must be true for the present values of these cash flows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts