Question: 2. please answer questions completely using multiple choice. Ergophonics Inc. initially has equity with market value $5 billion. It has no debt The equity has

2.

please answer questions completely using multiple choice.

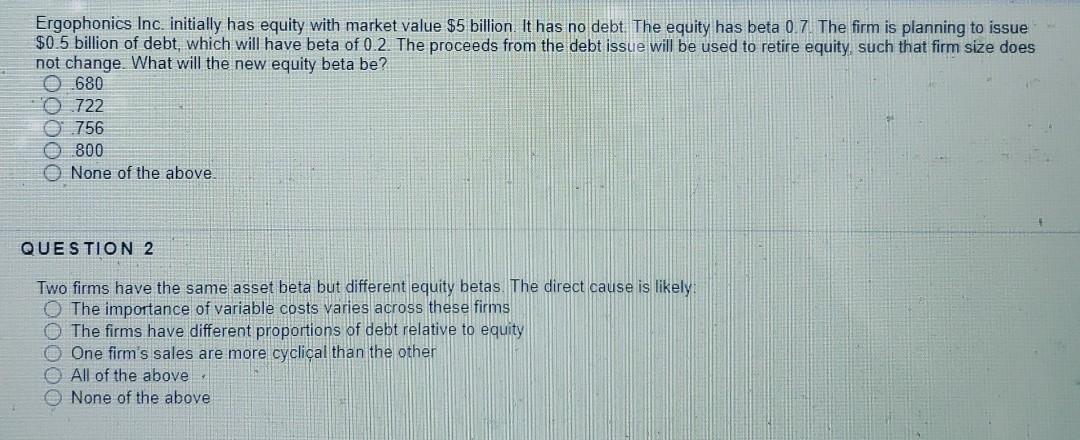

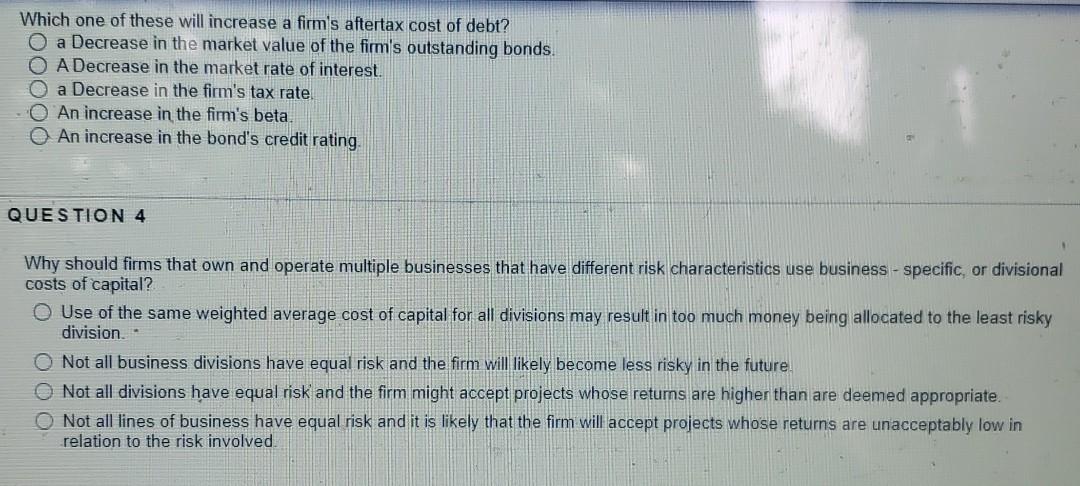

Ergophonics Inc. initially has equity with market value $5 billion. It has no debt The equity has beta 0.7. The firm is planning to issue $0.5 billion of debt, which will have beta of 0.2. The proceeds from the debt issue will be used to retire equity, such that firm size does not change. What will the new equity beta be? 680 0722 756 800 None of the above QUESTION 2 Two firms have the same asset beta but different equity betas. The direct cause is likely The importance of variable costs varies across these firms The firms have different proportions of debt relative to equity O One firm's sales are more cyclical than the other All of the above. e None of the above Which one of these will increase a firm's aftertax cost of debt? O a Decrease in the market value of the firm's outstanding bonds. O A Decrease in the market rate of interest. O a Decrease in the firm's tax rate An increase in the firm's beta. An increase in the bond's credit rating QUESTION 4 Why should firms that own and operate multiple businesses that have different risk characteristics use business - specific, or divisional costs of capital? O Use of the same weighted average cost of capital for all divisions may result in too much money being allocated to the least risky division- O Not all business divisions have equal risk and the firm will likely become less risky in the future. Not all divisions have equal risk and the firm might accept projects whose returns are higher than are deemed appropriate. O Not all lines of business have equal risk and it is likely that the firm will accept projects whose returns are unacceptably low in relation to the risk involved

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts