Question: 2. please answer questions completely using multiple choice M & M Proposition II says that the WACC is not influenced by changing the mix of

2.

please answer questions completely using multiple choice

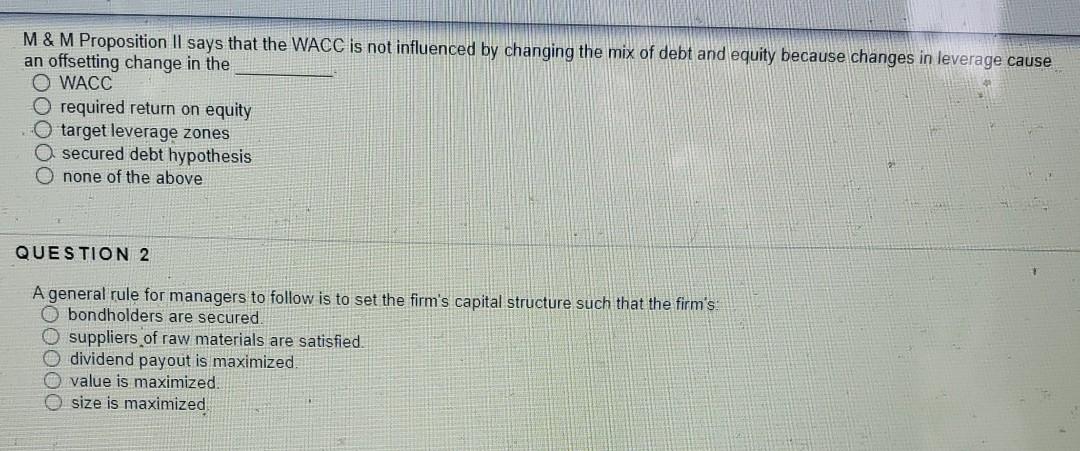

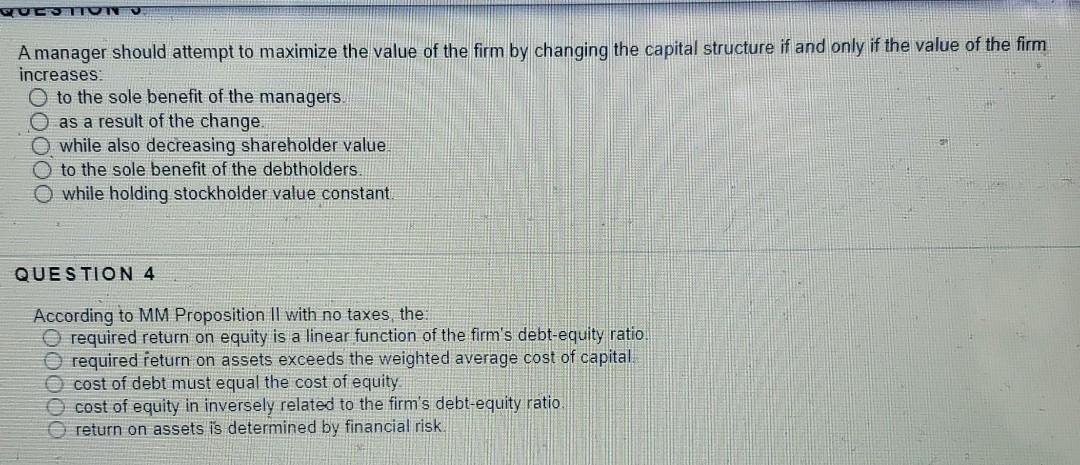

M & M Proposition II says that the WACC is not influenced by changing the mix of debt and equity because changes in leverage cause an offsetting change in the O WACC O required return on equity O target leverage zones O secured debt hypothesis O none of the above QUESTION 2 A general rule for managers to follow is to set the firm's capital structure such that the firm's: O bondholders are secured. O suppliers of raw materials are satisfied. O dividend payout is maximized. O value is maximized. size is maximized SUCOTTUTV A manager should attempt to maximize the value of the firm by changing the capital structure if and only if the value of the firm increases O to the sole benefit of the managers as a result of the change. while also decreasing shareholder value. to the sole benefit of the debtholders. while holding stockholder value constant QUESTION 4 According to MM Proposition II with no taxes, the required return on equity is a linear function of the firm's debt-equity ratio. required return on assets exceeds the weighted average cost of capital. cost of debt must equal the cost of equity cost of equity in inversely related to the firm's debt-equity ratio return on assets is determined by financial risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts