Question: 2. please answer questions completely using multiple choice Generally, you would expect the beta of debt for a firm to be Negative The same as

2.

please answer questions completely using multiple choice

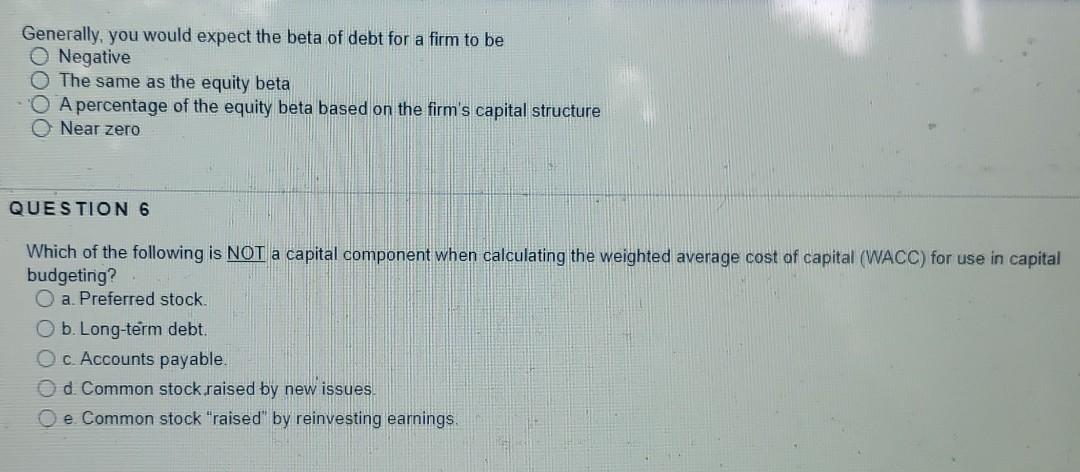

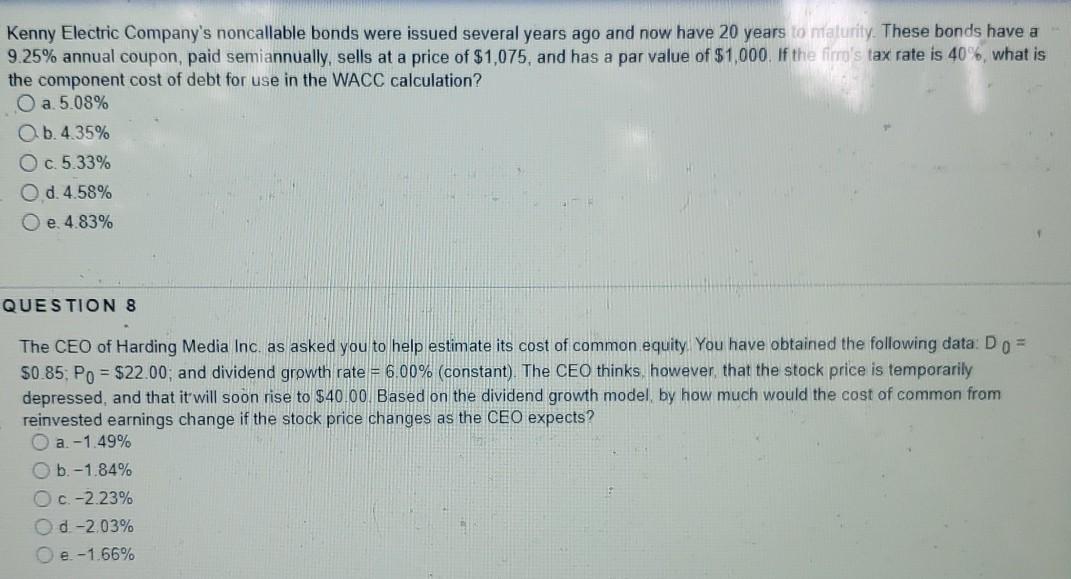

Generally, you would expect the beta of debt for a firm to be Negative The same as the equity beta A percentage of the equity beta based on the firm's capital structure Near zero QUESTION 6 Which of the following is NOT a capital component when calculating the weighted average cost of capital (WACC) for use in capital budgeting? O a. Preferred stock. O b. Long-term debt. O c Accounts payable. Od Common stock raised by new issues O e Common stock "raised" by reinvesting earnings Kenny Electric Company's noncallable bonds were issued several years ago and now have 20 years to malurity. These bonds have a 9.25% annual coupon, paid semiannually, sells at a price of $1,075, and has a par value of $1,000. If the firra's tax rate is 40%, what is the component cost of debt for use in the WACC calculation? O a. 5.08% b.4.35% O c.5.33% O d. 4.58% O e. 4.83% QUESTION 8 The CEO of Harding Media Inc. as asked you to help estimate its cost of common equity. You have obtained the following data: Do = $0.85: Po = $22.00; and dividend growth rate = 6.00% (constant). The CEO thinks, however that the stock price is temporarily depressed, and that it will soon rise to $40.00 Based on the dividend growth model by how much would the cost of common from reinvested earnings change if the stock price changes as the CEO expects? O a. -1.49% b.-1.84% OC.-2.23% Od-2.03% e. -1.66%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts