Question: 2. please answer questions completely using multiple choice. Which of the following statements is FALSE? O When evaluating any potential investment project, we must use

2.

please answer questions completely using multiple choice.

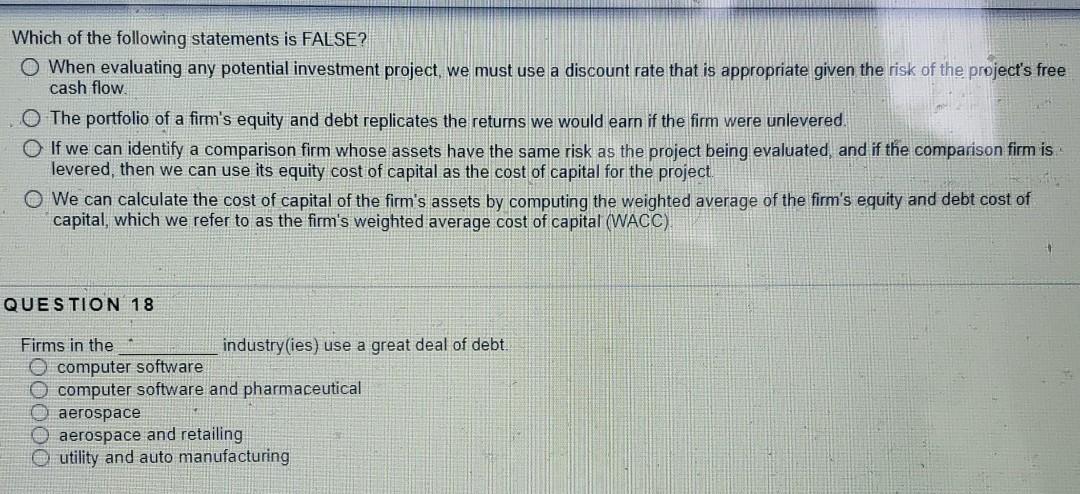

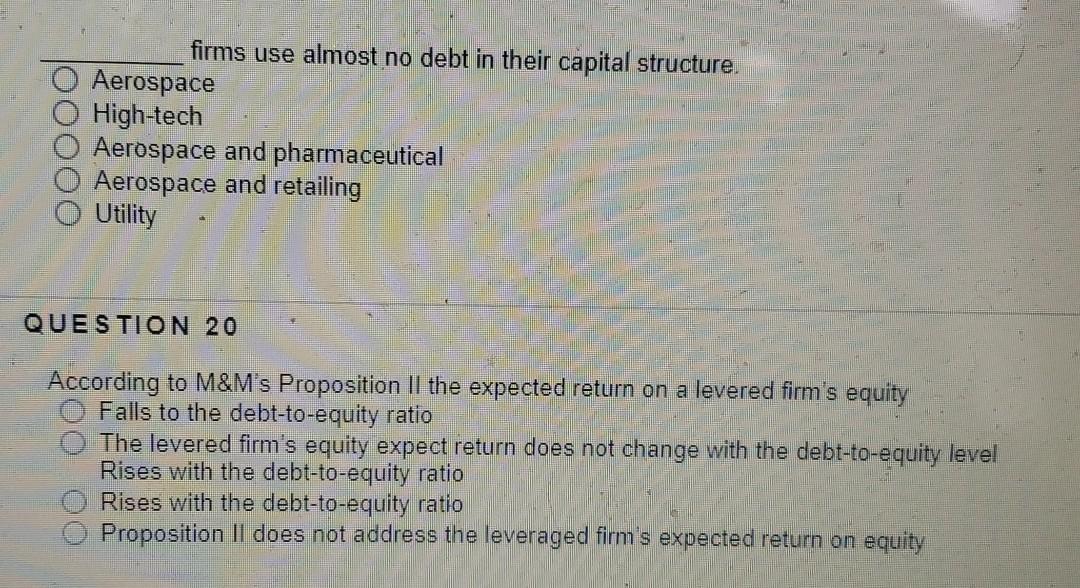

Which of the following statements is FALSE? O When evaluating any potential investment project, we must use a discount rate that is appropriate given the risk of the project's free cash flow. The portfolio of a firm's equity and debt replicates the retums we would earn if the firm were unlevered. If we can identify a comparison firm whose assets have the same risk as the project being evaluated and if the comparison firm is levered, then we can use its equity cost of capital as the cost of capital for the project. O We can calculate the cost of capital of the firm's assets by computing the weighted average of the firm's equity and debt cost of capital, which we refer to as the firm's weighted average cost of capital (WACC). QUESTION 18 Firms in the industry(ies) use a great deal of debt. computer software O computer software and pharmaceutical O aerospace aerospace and retailing utility and auto manufacturing oooo firms use almost no debt in their capital structure. Aerospace High-tech Aerospace and pharmaceutical Aerospace and retailing Utility QUESTION 20 According to M&M's Proposition II the expected return on a levered firm's equity Falls to the debt-to-equity ratio The levered firm's equity expect return does not change with the debt-to-equity level Rises with the debt-to-equity ratio Rises with the debt-to-equity ratio Proposition Il does not address the leveraged firm's expected return on equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts