Question: Please check the full question in picture. Please explain how to calculate this to get an answer like the key above for number 146, 147,

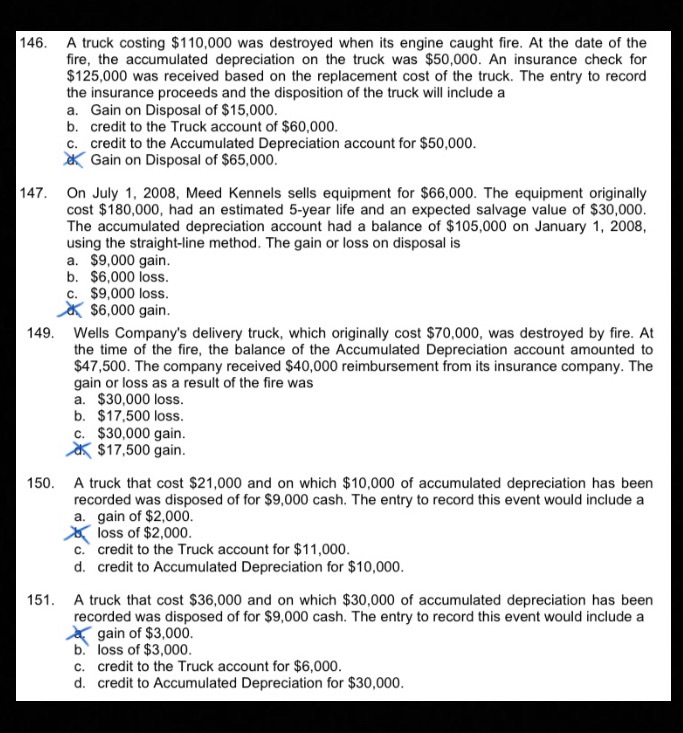

Please check the full question in picture. Please explain how to calculate this to get an answer like the key above for number 146, 147, 149, 150 and 151PLANT ASSETS, NATURAL RESOURCES, AND INTANGIBLE ASSETS146. A truck costing $110,000 was destroyed when its engine caught fire. At the date of the fire, the accumulated depreciation on the truck was $50,000. An insurance check for $125,000 was received based on the replacement cost of the truck. The entry to record the insurance proceeds and the disposition of the truck will include a147. On July 1, 2008, Meed Kennels sells equipment for $66,000. The equipment originally cost $180,000, had an estimated 5-year life and an expected salvage value of $30,000. The accumulated depreciation account had a balance of $105,000 on January 1, 2008, using the straight-line method. The gain or loss on disposal is149. On July 1, 2008, Meed Kennels sells equipment for $66,000. The equipment originally cost $180,000, had an estimated 5-year life and an expected salvage value of $30,000. The accumulated depreciation account had a balance of $105,000 on January 1, 2008, using the straight-line method. The gain or loss on disposal is150. A truck that cost $21,000 and on which $10,000 of accumulated depreciation has been recorded was disposed of for $9,000 cash. The entry to record this event would include a151. A truck that cost $36,000 and on which $30,000 of accumulated depreciation has been recorded was disposed of for $9,000 cash. The entry to record this event would include a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts