Question: Please check the full question in picture. Please explain how to calculate this to get an answer like the key above for number 107, 108,

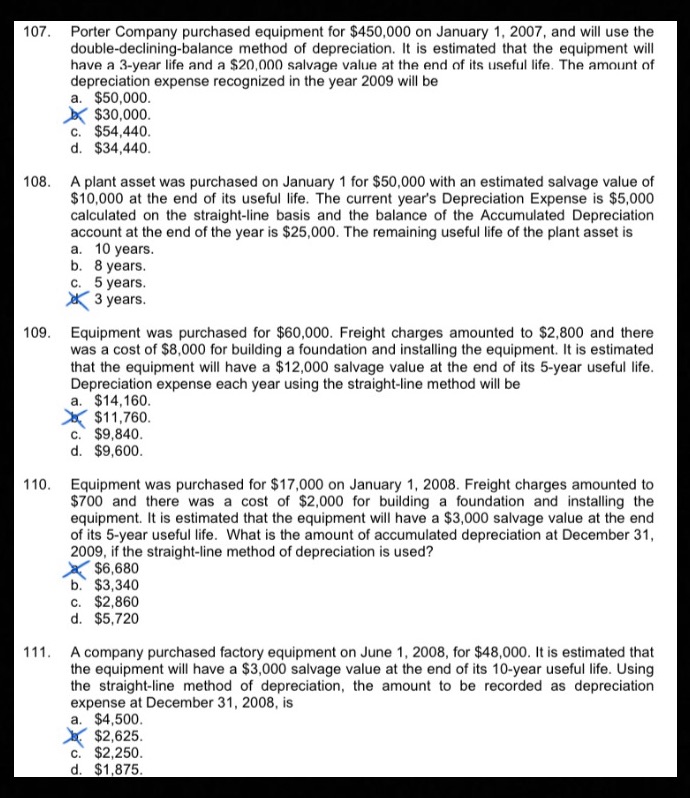

Please check the full question in picture. Please explain how to calculate this to get an answer like the key above for number 107, 108, 109, 110, and 111PLANT ASSETS, NATURAL RESOURCES, AND INTANGIBLE ASSETS 107. Porter Company purchased equipment for $450,000 on January 1, 2007, and will use the double-declining-balance method of depreciation. It is estimated that the equipment will have a 3-year life and a $20,000 salvage value at the end of its useful life. The amount of depreciation expense recognized in the year 2009 will be108. A plant asset was purchased on January 1 for $50,000 with an estimated salvage value of $10,000 at the end of its useful life. The current year's Depreciation Expense is $5,000 calculated on the straight-line basis and the balance of the Accumulated Depreciation account at the end of the year is $25,000. The remaining useful life of the plant asset is109. Equipment was purchased for $60,000. Freight charges amounted to $2,800 and there was a cost of $8,000 for building a foundation and installing the equipment. It is estimated that the equipment will have a $12,000 salvage value at the end of its 5-year useful life. Depreciation expense each year using the straight-line method will be110. Equipment was purchased for $17,000 on January 1, 2008. Freight charges amounted to $700 and there was a cost of $2,000 for building a foundation and installing the equipment. It is estimated that the equipment will have a $3,000 salvage value at the end of its 5-year useful life. What is the amount of accumulated depreciation at December 31, 2009, if the straight-line method of depreciation is used?111. A company purchased factory equipment on June 1, 2008, for $48,000. It is estimated that the equipment will have a $3,000 salvage value at the end of its 10-year useful life. Using the straight-line method of depreciation, the amount to be recorded as depreciation expense at December 31, 2008, is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts