Question: Please check the full question in picture. Please explain how to calculate this to get an answer like the key above for number 116, 117,

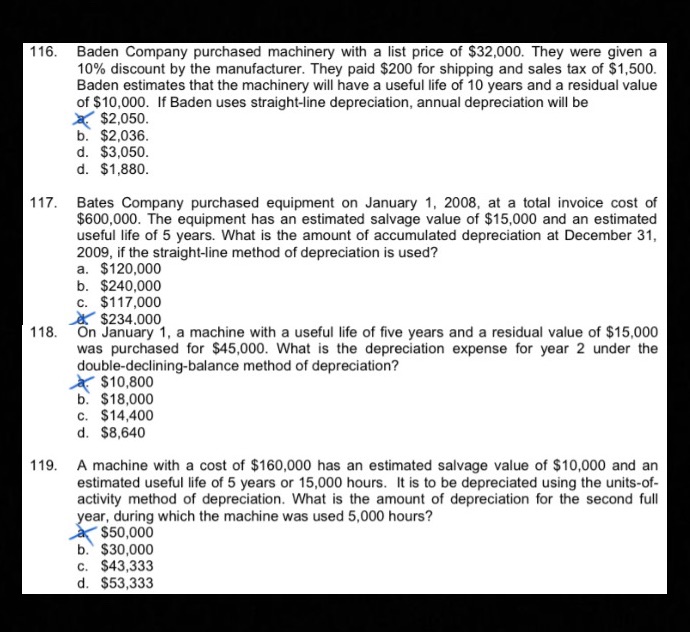

Please check the full question in picture. Please explain how to calculate this to get an answer like the key above for number 116, 117, 118, and 119PLANT ASSETS, NATURAL RESOURCES, AND INTANGIBLE ASSETS116. Baden Company purchased machinery with a list price of $32,000. They were given a 10% discount by the manufacturer. They paid $200 for shipping and sales tax of $1,500. Baden estimates that the machinery will have a useful life of 10 years and a residual value of $10,000. If Baden uses straight-line depreciation, annual depreciation will be117. Bates Company purchased equipment on January 1, 2008, at a total invoice cost of $600,000. The equipment has an estimated salvage value of $15,000 and an estimated useful life of 5 years. What is the amount of accumulated depreciation at December 31, 2009, if the straight-line method of depreciation is used?118. On January 1, a machine with a useful life of five years and a residual value of $15,000 was purchased for $45,000. What is the depreciation expense for year 2 under the double-declining-balance method of depreciation?119. A machine with a cost of $160,000 has an estimated salvage value of $10,000 and an estimated useful life of 5 years or 15,000 hours. It is to be depreciated using the units-of- activity method of depreciation. What is the amount of depreciation for the second full year, during which the machine was used 5,000 hours?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts