Question: Please check the full question in picture. Please explain how to calculate this to get an answer like the key above for number 86, 87,

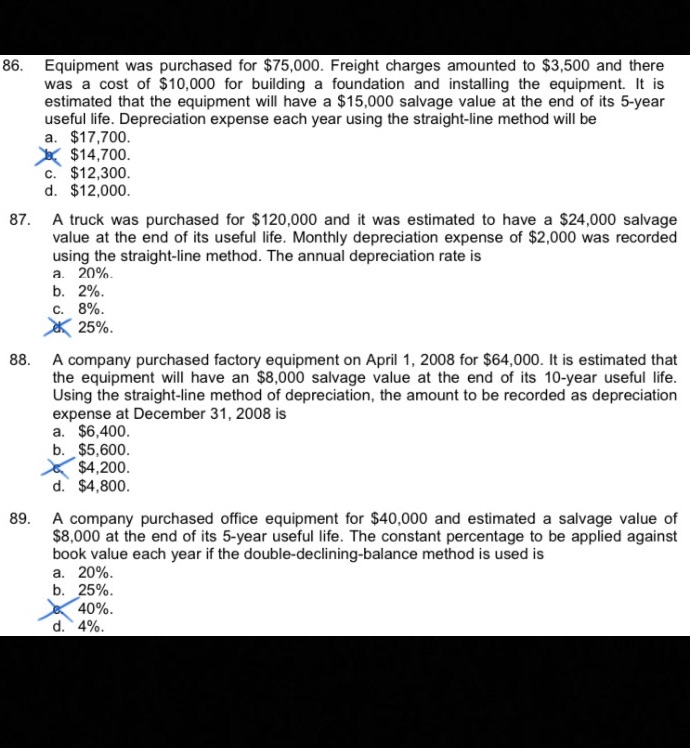

Please check the full question in picture. Please explain how to calculate this to get an answer like the key above for number 86, 87, 88, and 89PLANT ASSETS, NATURAL RESOURCES, AND INTANGIBLE ASSETS86. Equipment was purchased for $75,000. Freight charges amounted to $3,500 and there was a cost of $10,000 for building a foundation and installing the equipment. It is estimated that the equipment will have a $15,000 salvage value at the end of its 5-year useful life. Depreciation expense each year using the straight-line method will be87. A truck was purchased for $120,000 and it was estimated to have a $24,000 salvage value at the end of its useful life. Monthly depreciation expense of $2,000 was recorded using the straight-line method. The annual depreciation rate is88. A company purchased factory equipment on April 1, 2008 for $64,000. It is estimated that the equipment will have an $8,000 salvage value at the end of its 10-year useful life. Using the straight-line method of depreciation, the amount to be recorded as depreciation expense at December 31, 2008 is89. A company purchased office equipment for $40,000 and estimated a salvage value of $8,000 at the end of its 5-year useful life. The constant percentage to be applied against book value each year if the double-declining-balance method is used is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts