Question: Please check the full question in picture. Please explain how to calculate this to get an answer like the key above for number 183, 184,

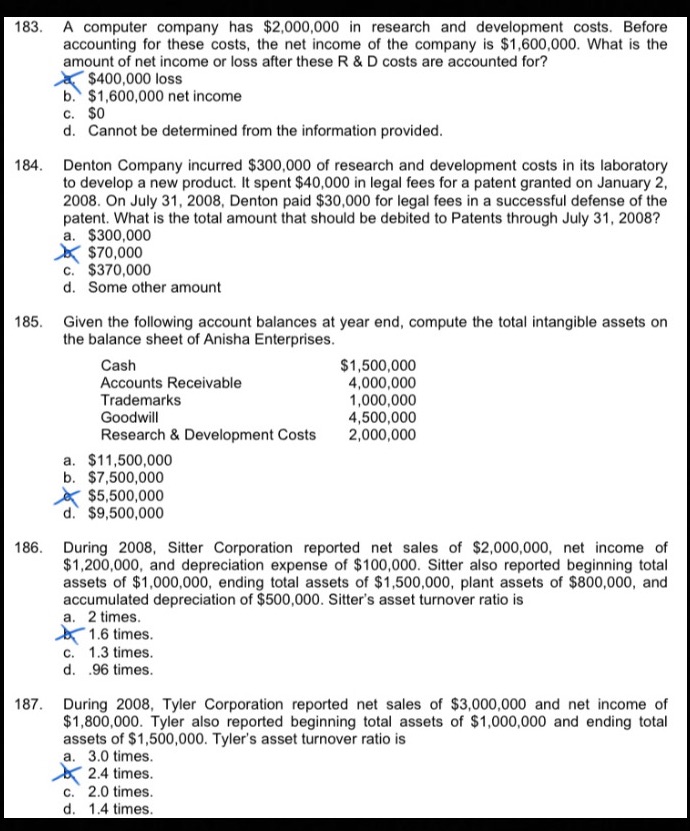

Please check the full question in picture. Please explain how to calculate this to get an answer like the key above for number 183, 184, 185, 186, and 187PLANT ASSETS, NATURAL RESOURCES, AND INTANGIBLE ASSETS183. A computer company has $2,000,000 in research and development costs. Before accounting for these costs, the net income of the company is $1,600,000. What is the amount of net income or loss after these R & D costs are accounted for?184. Denton Company incurred $300,000 of research and development costs in its laboratory to develop a new product. It spent $40,000 in legal fees for a patent granted on January 2, 2008. On July 31, 2008, Denton paid $30,000 for legal fees in a successful defense of the patent. What is the total amount that should be debited to Patents through July 31, 2008?185. Given the following account balances at year end, compute the total intangible assets on the balance sheet of Anisha Enterprises.CashAccounts Receivable TrademarksGoodwillResearch & Development Costs186. During 2008, Sitter Corporation reported net sales of $2,000,000, net income of $1,200,000, and depreciation expense of $100,000. Sitter also reported beginning total assets of $1,000,000, ending total assets of $1,500,000, plant assets of $800,000, and accumulated depreciation of $500,000. Sitter's asset turnover ratio is187. During 2008, Tyler Corporation reported net sales of $3,000,000 and net income of $1,800,000. Tyler also reported beginning total assets of $1,000,000 and ending total assets of $1,500,000. Tyler's asset turnover ratio is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts