Question: Please check the full question in picture. Please explain how to calculate this to get an answer like the key above for number 191, 192,

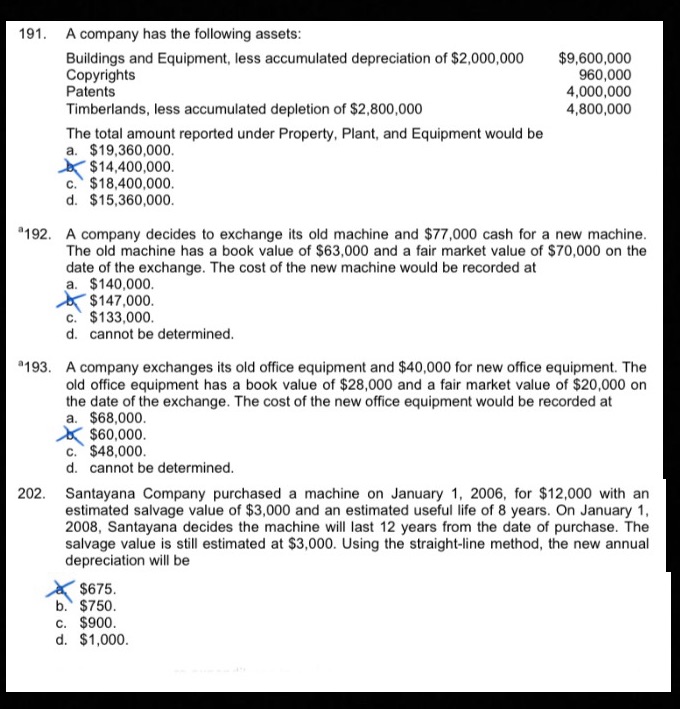

Please check the full question in picture. Please explain how to calculate this to get an answer like the key above for number 191, 192, 193, and 202PLANT ASSETS, NATURAL RESOURCES, AND INTANGIBLE ASSETS191. A company has the following assets: The total amount reported under Property, Plant, and Equipment would be192. A company decides to exchange its old machine and $77,000 cash for a new machine. The old machine has a book value of $63,000 and a fair market value of $70,000 on the date of the exchange. The cost of the new machine would be recorded at193. A company exchanges its old office equipment and $40,000 for new office equipment. The old office equipment has a book value of $28,000 and a fair market value of $20,000 on the date of the exchange. The cost of the new office equipment would be recorded at202. Santayana Company purchased a machine on January 1, 2006, for $12,000 with an estimated salvage value of $3,000 and an estimated useful life of 8 years. On January 1, 2008, Santayana decides the machine will last 12 years from the date of purchase. The salvage value is still estimated at $3,000. Using the straight-line method, the new annual depreciation will be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts