Question: Please check the full question in picture. Please explain how to calculate this to get an answer like the key above for number 152, 153,

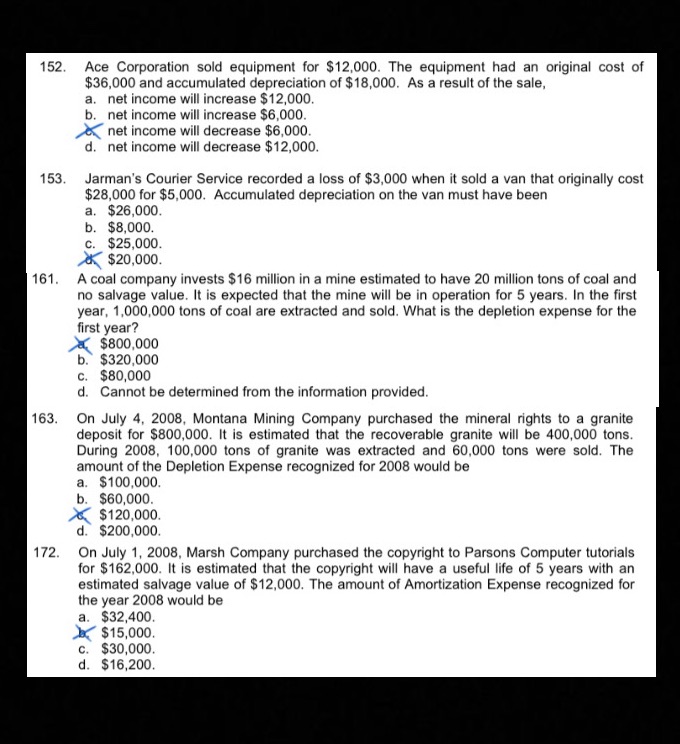

Please check the full question in picture. Please explain how to calculate this to get an answer like the key above for number 152, 153, 161, 163, and 172PLANT ASSETS, NATURAL RESOURCES, AND INTANGIBLE ASSETS152. Ace Corporation sold equipment for $12,000. The equipment had an original cost of $36,000 and accumulated depreciation of $18,000. As a result of the sale,153. Jarman's Courier Service recorded a loss of $3,000 when it sold a van that originally cost $28,000 for $5,000. Accumulated depreciation on the van must have been161. A coal company invests $16 million in a mine estimated to have 20 million tons of coal and no salvage value. It is expected that the mine will be in operation for 5 years. In the first year, 1,000,000 tons of coal are extracted and sold. What is the depletion expense for the first year?163. On July 4, 2008, Montana Mining Company purchased the mineral rights to a granite deposit for $800,000. It is estimated that the recoverable granite will be 400,000 tons. During 2008, 100,000 tons of granite was extracted and 60,000 tons were sold. The amount of the Depletion Expense recognized for 2008 would be172. On July 1, 2008, Marsh Company purchased the copyright to Parsons Computer tutorials for $162,000. It is estimated that the copyright will have a useful life of 5 years with an estimated salvage value of $12,000. The amount of Amortization Expense recognized for the year 2008 would be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts