Question: Please check the full question in picture. Please explain how to calculate this to get an answer like the key above for number 124, 125,

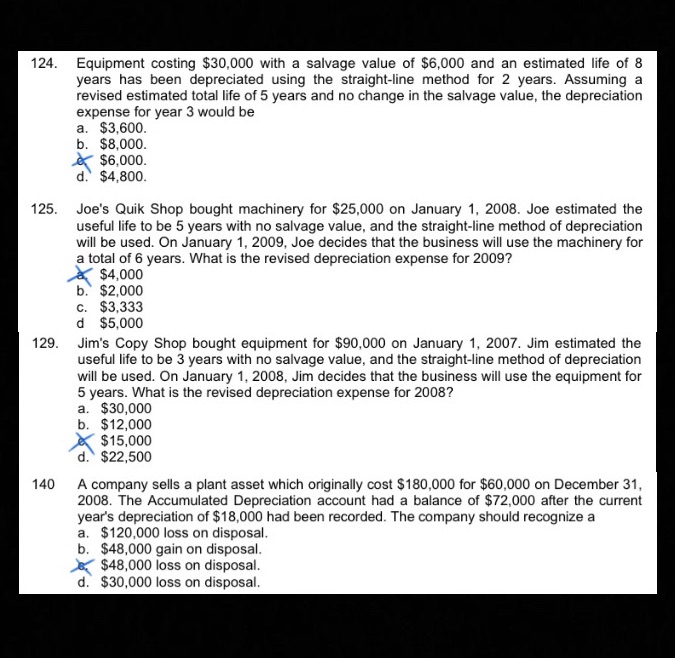

Please check the full question in picture. Please explain how to calculate this to get an answer like the key above for number 124, 125, 129, and 146PLANT ASSETS, NATURAL RESOURCES, AND INTANGIBLE ASSETS124. Equipment costing $30,000 with a salvage value of $6,000 and an estimated life of 8 years has been depreciated using the straight-line method for 2 years. Assuming a revised estimated total life of 5 years and no change in the salvage value, the depreciation expense for year 3 would be125. Joe's Quik Shop bought machinery for $25,000 on January 1, 2008. Joe estimated the useful life to be 5 years with no salvage value, and the straight-line method of depreciation will be used. On January 1, 2009, Joe decides that the business will use the machinery for a total of 6 years. What is the revised depreciation expense for 2009?129. Jim's Copy Shop bought equipment for $90,000 on January 1, 2007. Jim estimated the useful life to be 3 years with no salvage value, and the straight-line method of depreciation will be used. On January 1, 2008, Jim decides that the business will use the equipment for 5 years. What is the revised depreciation expense for 2008?140. A company sells a plant asset which originally cost $180,000 for $60,000 on December 31, 2008. The Accumulated Depreciation account had a balance of $72,000 after the current year's depreciation of $18,000 had been recorded. The company should recognize a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts