![]()

![]() New Semester Started

Get 50% OFF

Study Help!

--h --m --s

Claim Now

New Semester Started

Get 50% OFF

Study Help!

--h --m --s

Claim Now

![]()

![]()

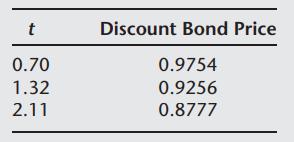

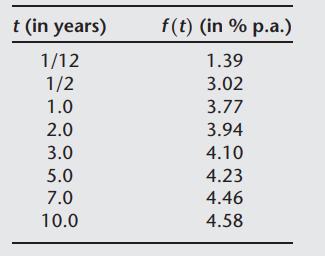

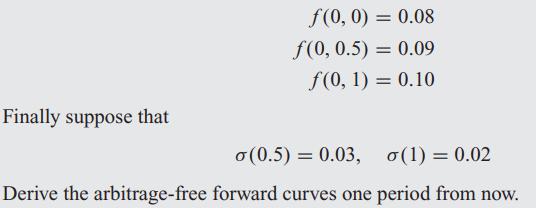

![Show that for T = t + h f(t+h, T) = f(t, T) +ah oh = -In[cosh(o h/)] h](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1704/9/6/1/775659fa6ef37d011704961775575.jpg)